Measuring the effectiveness of a scan-and-populate solution is simple. The more documents it recognizes and the more data it extracts from those documents, the greater the value it brings to your 1040 tax workflow.

SurePrep’s 1040SCAN is the industry’s leading scan-and-populate solution. Only 1040SCAN auto-verifies Optical Character Recognition (OCR) data for 65% of standard documents with patented, AI-powered technology. Our OCR automates 4–7 times as many documents as alternatives. And only 1040SCAN recognizes Grantor Letters, Federal Organizer pages, and State K-1s (see our Document Coverage list).

Today, we’re excited to announce that the best scan and populate solution on the market has made another cutting-edge leap: 1040SCAN now captures data from Schedule K-1 supplemental pages. Our reclassification tool lets you sort this information into the appropriate income and expense categories. As always, the finalized data exports directly to your tax software.

Automatic data capture for K-1 supplemental pages with our scan and populate solution (1040SCAN)

K-1s tend to be complex. Their footnotes often contain the most granular data in a tax return, which is why no other scan and populate solution recognizes data from Schedule K-1s—much less their supplemental info. Because manually entering K-1 information is such a time-consuming process, firms that use SurePrep solutions enjoy a distinct advantage. The addition of automatic data capture for K-1 supplemental pages to our unmatched document coverage will increase your firm’s productivity even further.

Without an automated solution, the K-1 data entry process looks like this:

- Preparers manually enter the data into Excel.

- They then reclass the data in a separate column.

- Finally, they input the final amounts into the tax software.

SurePrep’s automatic data capture of K-1 supplemental pages fully automates steps 1 and 3, and simplifies step 2.

Rather than spending billable hours on data entry, preparers can use 1040SCAN to extract data from K-1 supplemental pages the way they would any other document. This update does not require any new learning for existing SurePrep users. Verifiers can use the Review Wizard to add, edit, verify, and delete supplemental data with the same ease as all other data extracted by 1040SCAN.

When the time preparers normally spend on manually entering supplemental info is reduced, those resources can be redirected to expand your firm’s efficiency in ways that weren’t previously possible.

K-1 reclassification with our workpaper system (SPbinder)

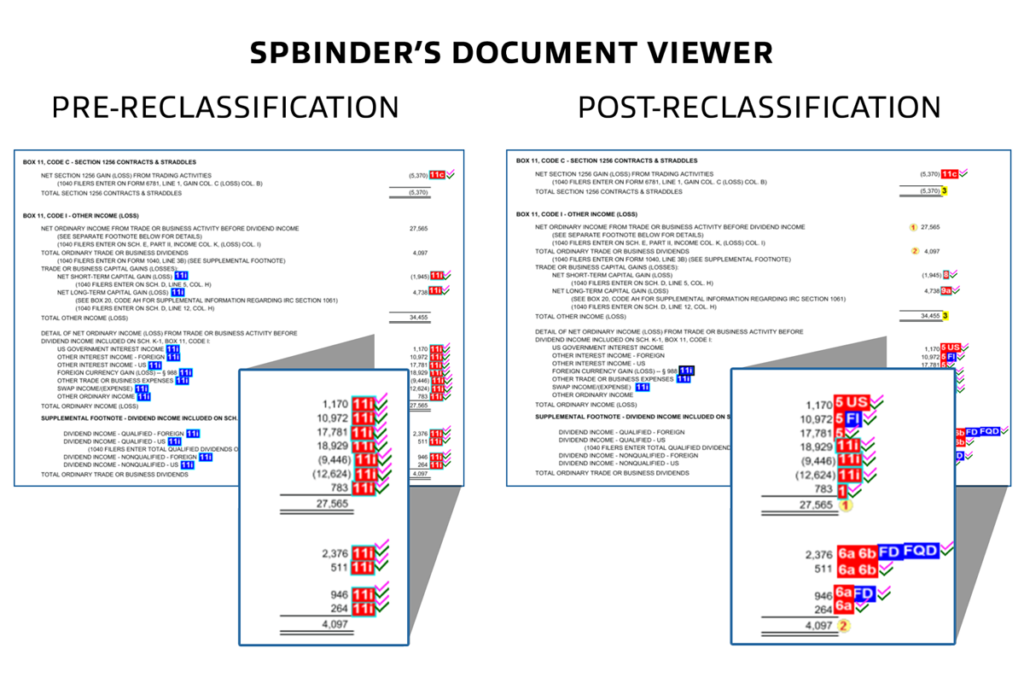

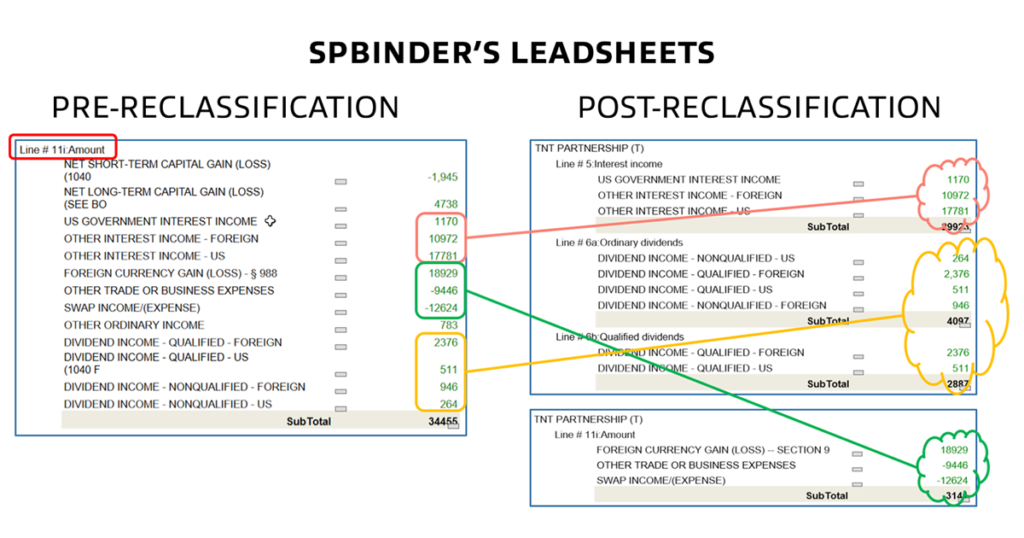

Once the K-1 supplemental data has been captured by 1040SCAN, SPbinder simplifies the reclassification step and fully automates the export to tax software. The reclassification enhancement lives under the new K-1 RECLASS tab. Here, preparers can review the K-1 supplemental data and assign amounts to the correct income and expense categories.

The data is automatically sorted into five columns for easy interpretation: Descriptions, Instructions, Amounts, Reclass to:, and Activity Name (Activity Type). Preparers reclass each row with a simple dropdown in the Reclass to: column. Once all items are appropriately assigned, one click of the Post Reclass button rearranges the information to the corresponding lines in the tax return. If the preparer makes an error, nothing is written in stone: they can access the K-1 RECLASS tab any time, reassign the faulty item, and post the changes.

After the reclass step, SPbinder automatically regenerates leadsheets with the reclassified K-1 amounts to save reviewer time. Leadsheets neatly organize the information and generate hyperlinked cross-references that connect each amount to the original source document.

Like all other tax return information in SPbinder, the K-1 lines export to your tax software with a single click.

The K-1 RECLASS feature is currently available to SurePrep customers using CCH Axcess™ Tax, and GoSystem Tax RS. A release for UltraTax CS and Lacerte users is coming soon.

Ever-evolving tax technology

SurePrep takes pride in developing the most productive solutions in the tax return preparation industry. As the leader in our field, we believe we have a responsibility to never settle for “good enough.” Our talented development team is constantly breaking new barriers in 1040 tax automation technology.

This K-1 reclassification tool update is part of our continued commitment to improving your 1040 tax process.

Learn more about this exciting development by watching our webinar recording.

Simplify K-1 prep and review with 1040SCAN’s supplemental page data extraction

View WebinarIf you are an existing SurePrep customer and wish to enable K-1 tax document automation for supplemental pages, contact your Client Success Manager to learn more.