Late document delivery and complex supplemental info make K-1 tax preparation one of the most challenging tasks in the 1040 process. Here’s what your firm needs to know about Schedule K-1s and how SurePrep solutions mitigate their friction points.

What is a Schedule K-1?

Schedule K-1s are federal tax documents used by pass-through entities to report individual income. Each partner is responsible for reporting their own share of profits, losses, deductions, and credits. Schedule K-1 info is reported on:

- Form 1065 for business partnerships

- Form 1120-S for S Corporations

- Form 1040 for individuals

- Form 1041 for beneficiaries of trusts and estates

K-1 tax preparation can be difficult

Schedule K-1s are known to cause headaches. Businesses must finalize financial details before they can deliver K-1s to owners. As a result, K-1s are often the last documents made available to taxpayers, which means your firm receives them late in the tax season.

K-1s are also notoriously difficult to capture with OCR. The lengthy supplemental pages vary so greatly that most software doesn’t capture them. Instead, preparers must enter the supplemental data in Excel, use complex formulas to calculate amounts, reclassify the numbers, then manually input those final amounts into the tax software.

In the bustling final month of tax season, this manual process can be a major inconvenience for already overworked preparers.

The solution: Leverage technology to streamline K-1 tax preparation

As the leader in 1040 tax automation, SurePrep helps firms neutralize the strain of K-1 tax preparation. Through a combination of 1040SCAN and SPbinder, your firm can:

- Automate data entry for K-1s and their supplemental data

- Simplify the reclassification of supplemental data with AI-powered software

Eliminate data entry with 1040SCAN

1040SCAN is the only scan-and-populate solution that recognizes K-1 documents and supplemental pages. Patented 1040SCAN technology auto-verifies 65% of standard documents. Our optional verification outsourcing service can eliminate verification entirely. While other firms spend billable hours manipulating and entering lengthy K-1 data, SurePrep customers can skip straight to reclassification in SPbinder.

Easy K-1 reclassification with SPbinder

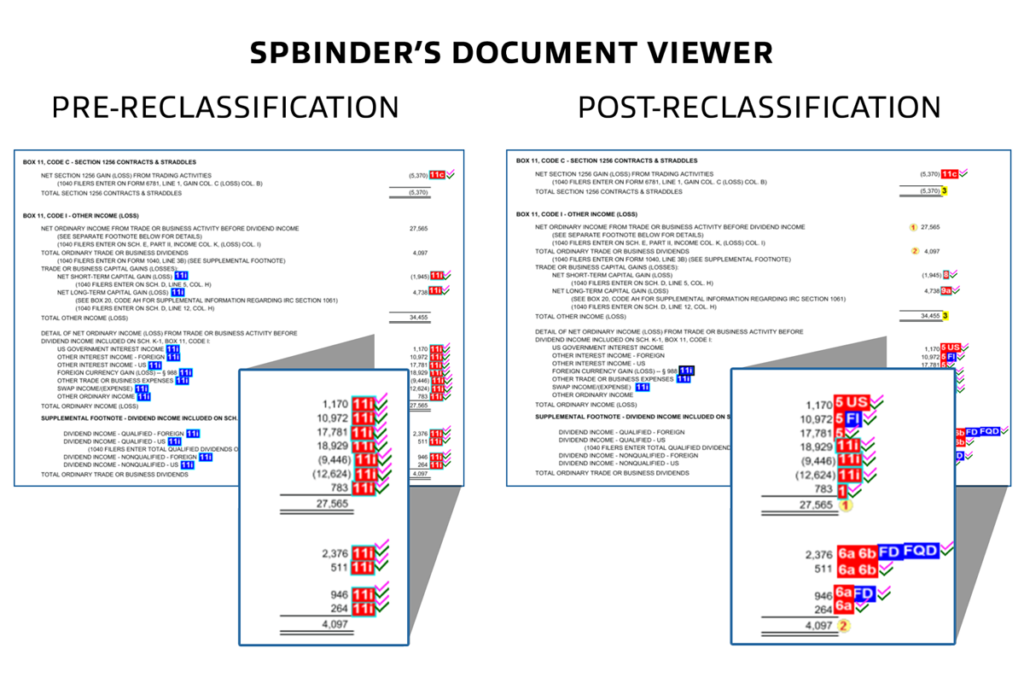

SPbinder is SurePrep’s workpaper management system and comes included with every purchase of 1040SCAN. SPbinder’s AI-powered K-1 Reclass feature makes it easy for preparers to organize supplemental info. Preparers can easily assign amounts to the correct income and expense categories using simple dropdown menus. Artificial Intelligence pre-populates the dropdowns with the best suggestions, which means preparers may only need to glance through.

Once all items are assigned, SPbinder exports the data to the tax software. These changes are then reflected throughout the entire binder, including on source documents, forms, and SPbinder Leadsheets. You can export the reclassified data to your tax software with a single click.

Work smarter with a modern tax preparation workflow

By listening closely to customers and investing in innovation, SurePrep continues to remove bottlenecks that other vendors don’t address. K-1 tax preparation doesn’t have to hold up your 1040 tax workflow. By using 1040SCAN and SPbinder, your firm can treat K-1s like any standard document.

View our webinar to gain a deeper understanding of how K-1 reclassification with SPbinder works.

Simplify K-1 prep and review with 1040SCAN’s supplemental page data extraction

View WebinarIf you are an existing SurePrep customer and wish to enable K-1 tax document automation, contact your Client Success Manager to learn more.