The June, 2020 TaxCaddy feature release gives your clients the option to make their Federal and State tax payments directly from TaxCaddy!

The new Tax Payment Processing by Check feature can be enabled by the tax professional with a single toggle. Once enabled, taxpayers will see a Pay By Check option for supported tax payments. Tax professionals are responsible for uploading payment vouchers and clearing them for official use by the relevant taxing authority.

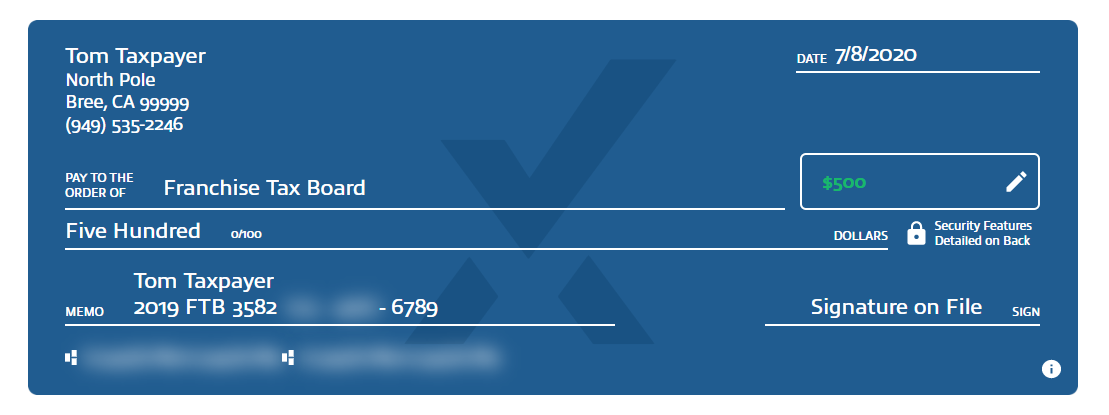

The Pay By Check dialogue walks taxpayers through every step. They will need to link and verify a bank account before making the first tax payment. TaxCaddy will help taxpayers who live in California or Virginia determine whether they are eligible to pay via check. A virtual check image gives taxpayers an easy way to review and confirm the payment details before TaxCaddy mails the real check on the taxpayer’s behalf.

Taxpayers will have the option to have the check mailed via USPS First Class or Certified mail. If Certified mail is selected, they will be able to visit the Tax Payments screen and select Track Payments from the Menu to track the check delivery status.

By default, taxpayers are responsible for shipping costs. However, firms have the option to cover some or all of the shipping costs on behalf of their clients.

For a full visual walkthrough, watch our feature video!

Current SurePrep customers, click here for release notes.

Current TaxCaddy users, click here for taxpayer instructions.

Shipping Discount!

TaxCaddy is offering a promotional discount on shipping! For a limited time, the cost of USPS Certified Mail has been reduced to $9.95 (normally priced at $14.95). Taxpayers can take advantage of this offer to get proof of delivery through electronic tracking numbers when using USPS Certified Mail.

*Offer expires January 1, 2023. Contact Sales to get the current offer details.

About TaxCaddy

TaxCaddy, a SurePrep product, is the finalist of the 2017 and 2018 CPA Practice Advisor Magazine’s Technology Innovation award. TaxCaddy reduces tax season workload compression by giving you access to your client’s 1099s, 1098s and W-2s the day they’re issued. TaxCaddy eliminates the cost and inefficiency of paper organizers. Plus, TaxCaddy lets you provide a much better client experience. To learn more about how TaxCaddy benefits tax professionals and taxpayers, visit our TaxCaddy product page. To learn what taxpayers are saying about TaxCaddy, visit TechValidate.