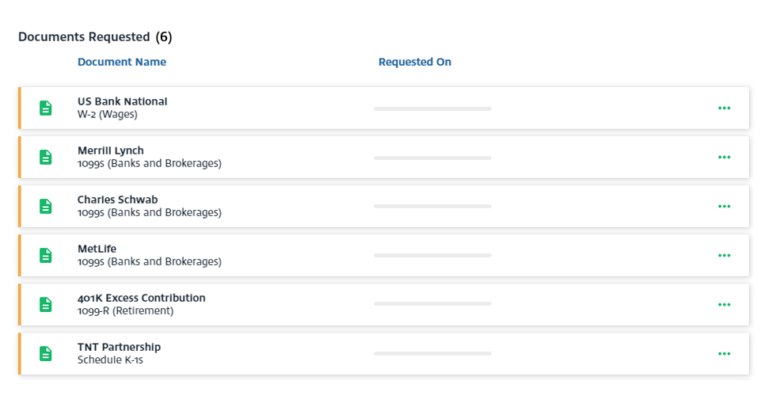

TaxCaddy’s automated Document Request List (DRL) is one of its most popular features. Using proforma data from your tax software, TaxCaddy generates custom DRLs for every taxpayer that can be distributed at scale with the click of a button. These dynamic DRLs function as a convenient tax season checklist by showing taxpayers and their tax professionals which documents are still outstanding.

Problem

But what happens when your firm signs a new client and their prior year data is not in your tax software?

Solution

SurePrep’s new tax return PDF extraction feature will spare you the data entry.

Benefit

SurePrep’s tax return PDF extraction feature will speed up the onboarding process for new clients. Instead of spending valuable time on data entry, your staff can focus on value-added work and client satisfaction. In conjunction with our client communication templates and unlimited TaxCaddy support, speedy TaxCaddy enrollment will help drive high adoption rates and create a seamless transition for new clients.

Solution steps

Simply upload a PDF of a prior year return and our OCR technology will automatically extract the information TaxCaddy needs to generate a DRL and export it to your tax software.

There are five simple steps to this process:

- Create a new record in your tax software.

- Create a new binder in FileRoom (our cloud-based binder service) and enter the record identifiers (e.g. Client Number) from your tax software.

- Let SurePrep extract and verify the return data.*

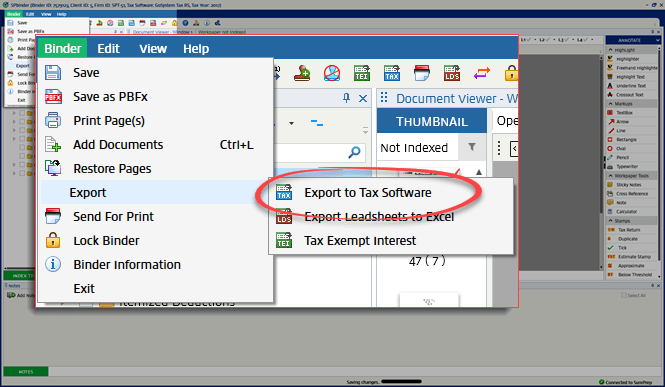

- Export the verified data to your tax software with a single click.

- That’s it! You can now use our rollover feature to generate this year’s binder and the TaxCaddy DRL from the proforma data, just as you would for existing clients.

*If you choose not to use SurePrep’s verification service, 1040SCANverify, you can still verify the data yourself with our user-friendly verification wizard.

To learn more about creating a positive first impression, we recommend our 2020 webinar, Digital Transformation Reduces Friction and Delivers a Modern 1040 Client Experience.

Compatibility

This feature currently accepts tax return PDFs from TY 2018 onward, if generated by one of the following sources:

- CCH Axcess Tax

- GoSystem Tax RS

- ProSystem fx Tax

- IRS

- TurboTax

Accepted documents

This feature recognizes the following documents:

- 1040 (including schedules 1 – 3)

- 1040NR – Pages 1 – 5

- Schedule A

- Schedule B (K-1 will be ignored)

- Schedule C

- Schedule D – for Carryovers only

- Schedule E – Pages 1 and 2

- Form 1116 – Foreign Tax Credit (including Carryovers)

- Form 2555 – Foreign Earned Income

- Form 4562 – Depreciation & Amortization/Schedules

- Form 8283 – If a Tax Return Draft has Schedule A as well as Form 8283, then OCR will always capture data from Form 8283 instead of Schedule A

- Form 8582 – Passive Activity Loss Limitations carryovers

- Form 8938 – Foreign Financial Assets

- FinCEN Form 114 – Report of Foreign Bank and Financial Accounts

- State Refund

- Qualified Dividends

- Estimate Tax Payments and Extension Payments (Federal)

- W-2 Box 1, 2, 3, 4, 5 and 6

- 1099-R (Federal tax withheld of IRA/Pension from statement page)

- Schedule F (Output Form) Gross Receipts, Other Income, Other Expenses – Cash basis and Gross Receipts, Other Expenses – Accrual basis

To learn more, submit the Talk To Sales form and someone will reach out to you.