Interactive Demonstration

Experience the entire SurePrep tax process from start to finish.

Download Success StoryWhen you work morning to night, no one wants to come home and be stuck doing taxes all night. TaxCaddy shortens the process tenfold.

— Kevin Frank, TaxCaddy user

Simplify the gathering and delivery of tax documents.

Kevin Frank

CCH Axcess Tax

TaxCaddy

Kevin Frank has been with his CPA firm ever since his first job out of high school, and he was determined to stay with them, even though he was moving out of town. He wondered how he would deliver his tax documents and get answers to tax-related questions if he could no longer drop by his CPA’s office.

Thankfully, Kevin’s CPA firm was in the process of implementing a new solution to facilitate electronic document delivery, messaging, and e-signatures. The firm wanted to provide their clients with the same modern experience many consumers have come to expect from today’s financial service providers. But the solution provided an unexpected benefit—easy collaboration with clients who lived out of town.

As a civil engineer, Kevin’s job is highly demanding. He spends all day at the office. Like many taxpayers, he dreaded opening the mailbox in January to discover the thick paper tax organizer. It felt like a delivery of homework. To further complicate matters, Kevin doesn’t own a printer or a copier, so he would have to take time out of his busy workday or the weekend to print or copy his W-2, 1099s, and other documents at the library before mailing them back to the firm. The entire process of answering the questionnaire, collecting the files, driving to and from the library, printing and copying the documents, and driving to the post office required many hours that Kevin didn’t have to spare.

“When you’re working all day, the whole process would probably take at least a week or two,” Kevin said.

Since switching to TaxCaddy, the time spent providing his documents, data, and signatures has decreased dramatically and Kevin is able to complete the tasks when it’s convenient for him.

“I definitely felt less rushed than I did with the paperwork. I felt like I could do it more on my own time,” Kevin said. “And the prompts were a good way to keep track of where I was in the process.”

Kevin utilized the TaxCaddy mobile app and the browser version to work on his return. The lengthy questionnaire was condensed into a format so simple that he was able to complete it during his lunch break. Using the photo-scanning feature of the TaxCaddy mobile app, Kevin was able to scan and convert paper documents into PDFs with the tap of a button and upload them securely.

One feature that proved to be a favorite of Kevin’s was TaxCaddy’s notes. Since some of Kevin’s tax documents needed an explanation, Kevin was able to proactively clarify issues by adding digital notes to those documents, saving time and trouble for his CPA. The improvements in all these areas combined to make tax season much easier than previous years.

“When you work morning to night, no one wants to come home and be stuck doing taxes all night,” Kevin said. “TaxCaddy shortened the process tenfold.”

Historically, tax season was time consuming and stressful but since switching to TaxCaddy Kevin has come to view it in an entirely different light. He was initially taken aback by how relaxed and casual the experience felt. His workload not only seemed lighter but also less urgent. Rather than taking on a mountain of paperwork all at once, he was able to fill out the questionnaire and fulfill the document requests when it was convenient for him. Kevin was in disbelief by the time he was finished.

When I was all done, I remember feeling like I was missing something. I was thinking there’s no way it could have been that easy, but it was. Tax time is stressful and this definitely took some stress out of the process. I would definitely recommend TaxCaddy to my friends and family. Actually, I think I have already.

Kevin Frank

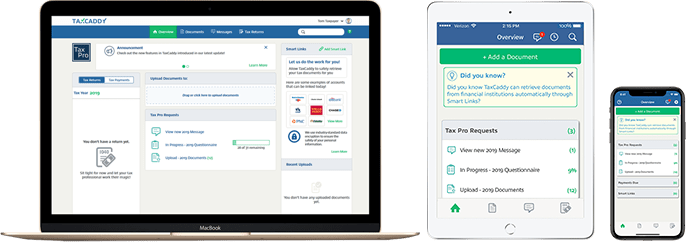

TaxCaddy uses proforma data in your existing tax software (CCH Axcess™ Tax, GoSystem Tax RS, Lacerte, UltraTax) to create a tailored questionnaire and document request list. Your clients can use the TaxCaddy app for iPhone, iPad and Android to complete the questionnaire when it’s convenient for them.

Leading banks, brokerages and payroll service providers can be linked to automatically retrieve 1098s, 1099s and W-2s as soon as they’re issued. Because the documents are available to you immediately, you can start the return sooner than ever before.

Your clients will love TaxCaddy’s e-signatures, in-app messaging and user-friendly design. You can even invoice your clients when you deliver the tax return. It’s a breeze to set up and simple to use.

Contact one of our product experts to ask questions or schedule a one-on-one demonstration.

Contact Sales