Interactive Demonstration

Experience the entire SurePrep tax process from start to finish.

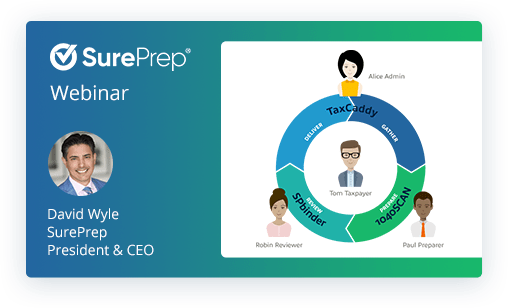

View this recorded webinar to learn how the combination of TaxCaddy, 1040SCAN and SPbinder allows you to get more work done in less time while dramatically improving client service. At the end of the session we spoke with a SurePrep customer that uses TaxCaddy and 1040SCANverify to streamline their 1040 tax preparation process.

The SurePrep tax process starts and ends with the taxpayer. From gathering client information to delivering the tax return and requesting payment, SurePrep’s 1040 tax solutions ensure a delightful client experience, and the most accurate and comprehensive data extraction and processing to streamline your 1040 tax process, decrease workload compression, and grow your bottom line.

We’ve transformed the tax season experience with TaxCaddy, a taxpayer collaboration system that eliminates the cost and inefficiency of paper organizers, and dramatically reduces data entry and administrative costs for your firm. Once your clients provide the requested documents, signatures, and complete the questionnaire through TaxCaddy, they can be sent to 1040SCAN, our scan and populate solution, which saves preparers time by automatically bookmarking, organizing and exporting data from 4x – 7x as many documents as its competitors. 1040SCAN further eliminates up to 2/3 of data entry for your tax professionals with our newly patented auto-verification technology. SurePrep is the only company offering 100% accuracy, no human verification for native PDFs!

Following 1040SCAN’s scan-and-populate with auto-verification, the client’s information is automatically indexed by SurePrep’s bespoke workpaper system, SPbinder. Reviewers use SPbinder’s notes, annotations, cross-references and sign-offs to review the workpapers more efficiently than ever before. When the return is done your clients will be delighted to review it and e-sign the 8879 with the tap of a finger, all from TaxCaddy.

Learn more in this informative webinar!

Subscribe to receive new whitepapers, webinars, blog posts, and other content once a month.

Contact one of our product experts to ask questions or schedule a one-on-one demonstration.

Contact Sales