Interactive Demonstration

Experience the entire SurePrep tax process from start to finish.

![]() Our solutions integrate with: CCH Axcess Tax, GoSystem Tax RS, Lacerte, and UltraTax CS.

Our solutions integrate with: CCH Axcess Tax, GoSystem Tax RS, Lacerte, and UltraTax CS.

TaxCaddy is the ultimate 1040 taxpayer collaboration software and provides the most taxpayer-focused tax client portal around.

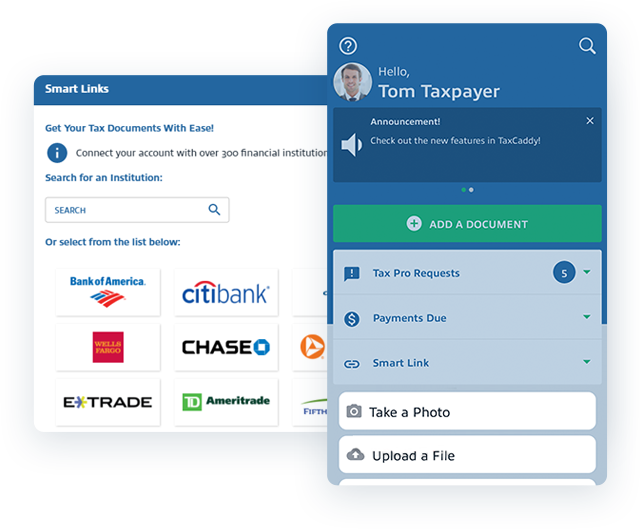

TaxCaddy makes it easy for taxpayers to upload documents throughout the year. Don’t wait around while your clients store documents in a pile and mail them in all at once. Workload compression drops dramatically when your staff get access to documents earlier in the tax season.

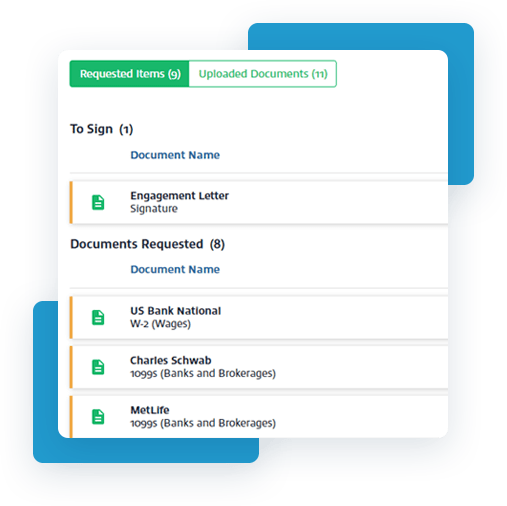

TaxCaddy creates an automated document request list based on the proforma data in your tax software. Both your staff and your clients can easily see which documents were already uploaded to the tax client portal and which are still outstanding.

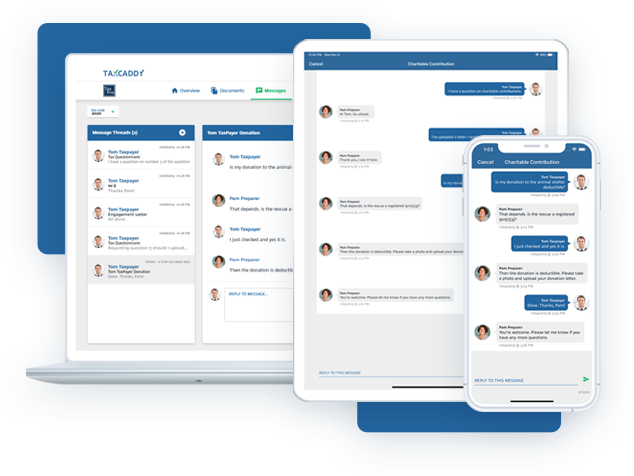

Other tax client portals focus on the firm’s convenience at the taxpayer’s expense. TaxCaddy is designed to delight both your staff and your clients. Address taxpayers’ needs with native iOS and Android mobile apps, mobile photo-scanning, e-signatures, and automated document retrieval. Offering modern conveniences improves client service.

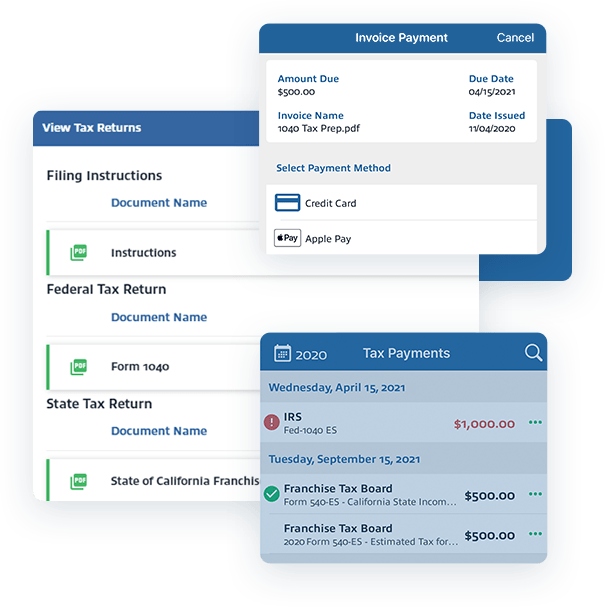

TaxCaddy makes it easy to deliver final tax returns, tax payment vouchers, and your firm’s invoice. Clients can render KBA e-signatures, make tax payments, and pay their invoice directly from the TaxCaddy app for iOS or Android.

Most firms use TaxCaddy in the Gather and Deliver phases. They request and receive documents from clients, then deliver the finished tax return, invoice, and other deliverables. These Gather and Deliver functions are available as separate options for firms that only need specific features.

See Options

Experience the entire SurePrep tax process from start to finish. Our interactive demonstration will walk you through TaxCaddy, 1040SCAN, and SPbinder from your team’s perspective. You’ll also see what our tax client portal looks like from the taxpayer’s point of view!

Go to Demo

Head over to the Learning Center for more in-depth information on TaxCaddy.

“It was so easy to take photos of all of the documents to send on. It saved me a tremendous amount of time. Made tax season less stressful!”

-A taxpayer user of TaxCaddy

92% of organizations agreed that:

“By offering technology options like TaxCaddy, we provide a better experience to our clients.”

“Almost every one of my clients that I sent the brochure to used it and loved it. I will be requiring those that have used the portal in the past to convert to TaxCaddy.”

-Partner, mid-size accounting firm

It’s what the clients want. More and more clients are becoming less enthusiastic about paper organizers. The benefit is faster responses from clients and not having to worry about unorganized emails and blurry photos of documents.

Lindsay Park, Perkins & Co

A lot of the other options were designed for the tax professional and had very little adoption for that client. TaxCaddy is designed around the convenience of the client which saw much better adoption.

Susan Theissen, Forvis

From a professional support perspective, you’re able to send your TaxCaddy clients all of their documents at once. It’s just a couple clicks and you’re sending it all out. We’re finding that wonderful.

Cindy Owens, Rehmann

What are taxpayers saying about TaxCaddy? Feedback collected by TechValidate, an independent 3rd party survey provider.

Contact us for product details or to schedule a one-on-one demonstration. After you submit the form, someone will call you within 1 business day (usually 1 business hour) to help you schedule a meeting with a product expert.

Our solutions only integrate with the following tax software: CCH Axcess Tax, GoSystem Tax RS, Lacerte, and UltraTax CS.