Interactive Demonstration

Experience the entire SurePrep tax process from start to finish.

Download Success StoryBy combining SurePrep’s technology with our own standardized processes and best practices, we effectively addressed some of the most pressing demands on today’s accounting and tax firms.

— Matt Becker, National Tax Managing Partner

Enhance standardization, increase productivity, and improve the client experience.

Matt Becker, National Tax Managing Partner

80,000+

GoSystem Tax RS

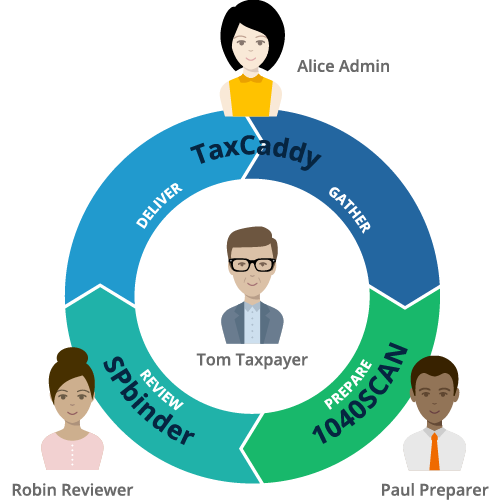

TaxCaddy, 1040SCAN, SPbinder

Tax and accounting firms face a variety of challenges across all fronts. They need first and foremost to deliver high-quality service and provide an excellent client experience. But to do so effectively, they should start from the inside out—attracting and retaining the best talent and ensuring these professionals have the bandwidth to focus on value-add consulting rather than routine data entry and number crunching—without compromising the integrity of client results.

But how can firms meet all these demands simultaneously? The answer lies in automation—by standardizing processes and taking advantage of scalable software and services, firms can automate and streamline activities for both their professionals and their clients.

For BDO, the individual income tax return preparation process fit the bill.

Despite the IRS introducing a new “simplified” Form 1040 for the 2019 tax year, taxpayers who claim certain deductions or credits, or who owe additional taxes, will still need to file additional forms, and of course, completing Form 1040 still requires careful information gathering, documentation, preparation and review from tax professionals. For a firm that handles more than 24,000 1040s annually, they represent a significant revenue stream.

To optimize the 1040 process, BDO assembled a cross-functional team to determine how best to address necessary service changes by leveraging new technology capabilities. The taskforce first mapped out the firm’s historical approach, and then sought to develop a new standard process manual for 1040 preparation to identify where and how automation could offer employees and clients the greatest benefit.

With a 15-year-plus relationship working with BDO, SurePrep was a natural fit to help enhance the new firm-wide 1040 process. Several SurePrep products were woven into various stages of the firm’s approach:

By leveraging a mix of service options and technology solutions, BDO vastly improved their 1040 process across the board. Benefits include:

Increased productivity

Improved client experience

More efficient use of time and talent

By combining SurePrep’s technology with our own standardized processes and best practices, we effectively addressed some of the most pressing demands on today’s accounting and tax firms.

Ultimately, this has been a successful example of tax transformation – we reduced the time spent on inefficient tasks and elevated the role of our tax professionals, all while delivering the highest level of service to our clients.

Matt Becker, National Tax Managing Partner

Contact one of our product experts to ask questions or schedule a one-on-one demonstration.

Contact Sales