Interactive Demonstration

Experience the entire SurePrep tax process from start to finish.

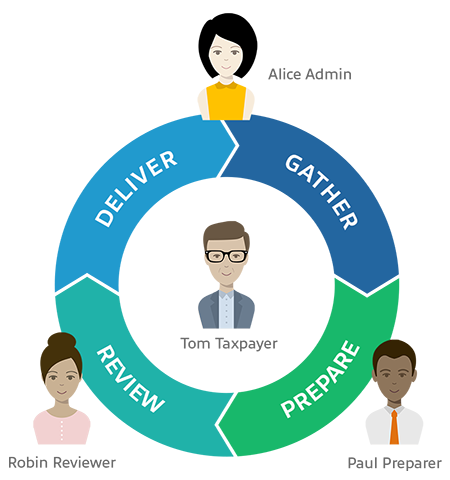

The 1040 tax return preparation process has stayed the same for decades:

While the process has stayed the same, the methods have evolved. Today’s most successful firms leverage technology to increase profits, enforce standardization, and improve client satisfaction. In this whitepaper, we’ll outline 5 steps your firm can implement this year to transform your 1040 process.

Before online portals, the 1040 process began with firms mailing bulky paper organizers to the taxpayers. Some firms still do. To taxpayers, these stacks of paper feel like homework. Organizers often end up forgotten in a drawer until the last minute. As a result, firms don’t receive documents until late March, which leads to stressful workload compression.

Early online portals tried to solve these problems, but only compounded them. Firms asked taxpayers to log in, download forms, print them out, and scan them back in. This was more convenient for the firms, but predictably did little to improve the client experience or solve for procrastination.

In 2016, SurePrep released a game-changing solution: TaxCaddy. This one-of-a-kind 1040 platform is accessible via browser and available as a mobile app for iOS and Android. We designed TaxCaddy around one core principle: increase convenience for both the taxpayer and tax professional.

TaxCaddy did a nice job of organizing my documents and checking to be sure I had everything uploaded to my tax professional. I rate it a 10 out of 10.

A Sassetti client

TaxCaddy, for our clients that use it, has replaced the paper organizer.[…] For our admin team, it’s really easy for them to push a button to send the documents to 1040SCAN.

Susan Penno, Partner

Sassetti LLC

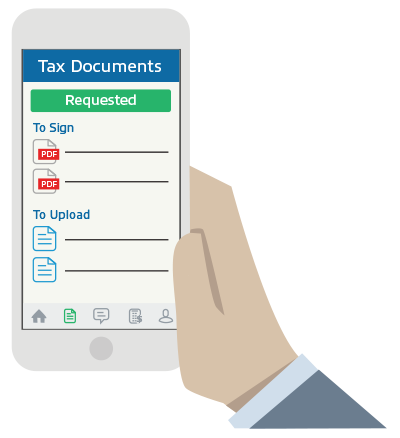

The most useful part of conventional paper organizers was the document request list (DRL). Taxpayers use DRLs to make sure they deliver everything their CPA needs to prepare the tax return. TaxCaddy simplifies DRL creation by referencing proforma data in your tax software to create custom DRLs at scale. On the taxpayer end, the DRL is interactive and automatically tracks completion as documents roll in.

TaxCaddy gives taxpayers new ways to deliver documents and complete their DRLs:

In situations where no document exists, taxpayers can simply reply to a DRL request with an amount.

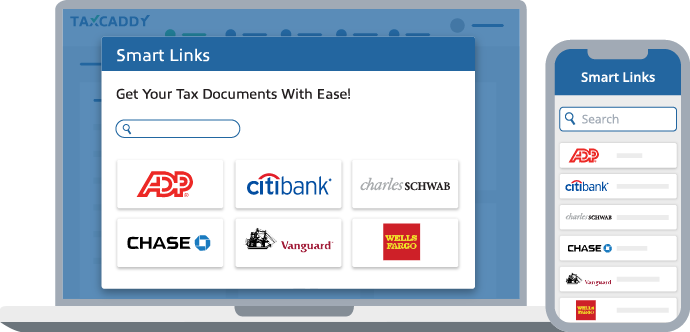

TaxCaddy’s Smart Links feature automatically retrieves documents from leading financial institutions. It checks for new tax documents once per day and imports them as soon as they become available. The taxpayer doesn’t need to lift a finger. Imagine having access to your clients’ documents the day they’re issued!

TaxCaddy also simplifies e-signatures. Your admins can easily send engagement and consent letters at scale. Clients can sign these and any other documents with a few taps. Documents that require IRS-compliant signatures, like Form 8879, are just as easy to sign with TaxCaddy’s built-in Knowledge-Based Authentication (KBA) service.

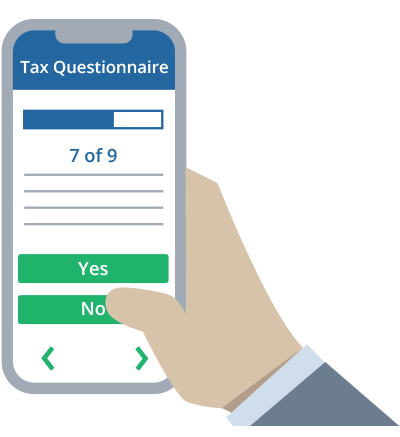

Finally, TaxCaddy transforms the questionnaire. Like DRLs, questionnaires auto-generate at scale from proforma data in your tax software. They adapt dynamically as clients answer and only display relevant questions. TaxCaddy auto-saves after every answer, so clients can make progress when it’s convenient for them.

Combined, these features radically simplify tax time for both your firm and your clients. The native mobile app makes the key difference. It puts the organizer, the scanner, the printer, and the pen in your clients’ pockets. Offering a mobile app is the single most powerful change your firm can make this year.

Other technology solutions have tried to reduce the tax preparer to a calculator. Your clients can get a calculator from anywhere. This is all about the client experience.

L. Gary Boomer, CPA, CITP

Boomer Consulting, Inc.

It took far less time to get the documents to our tax preparer and for her to prepare our return. So we were able to file earlier and at a more convenient time for us. It saved so much time previously spent in gathering and sending documents to our tax preparer and it was EASY.

a TaxCaddy user

We had many clients sign up for their free TaxCaddy account. We had more organizers completed than in any previous year. We received documents quicker than any previous year. But most impressive is the actual client base using this software. We had multiple clients use this option that have refused to use our client portal in the past and demanded paper returns and organizers . . . helping us realize that they didn’t hate technology, they hated the technology we were offering. As soon as we offered a solution that wasn’t cumbersome to them, they jumped aboard the tech train.

Jerica Hernandez, Client Experience Manager, Allman Johnson CPAs & Advisors from the Boomer Guide to simplifying tax time

In 2020, SurePrep surveyed tax professionals in senior positions about their firms’ 1040 processes. Half of respondents admitted they did not use a scan-and-populate solution to automate data entry. A smaller fraction of respondents confessed they did not perform front-end scanning at all.

If your firm does not yet automate data entry, it’s critical to start. Scan-and-populate solutions use optical character recognition (OCR) to extract data from tax documents. After verification, the data exports directly to your tax software. The potential time savings of ditching manual data entry are immense.

That said, it’s critical to choose the right software. If your OCR software doesn’t automate enough documents, you won’t generate enough time savings to justify your investment. That’s why we’ve invested significant resources to give 1040SCAN the broadest document coverage in the entire industry.

1040SCAN recognizes 4–7x as many documents as the closest competitors. In fact, it leads the industry in every document category. 1040SCAN recognizes 39 source document types like W-2s, 1098s and 5498s. In comparison, CCH Scan only covers 21 document types while Lacerte covers 11 and UltraTax covers 35.

1040SCAN also recognizes 546 brokerage statements compared to:

We dropped about 20% on hours spent processing roughly the same amount of tax returns. That’s a huge savings and an incredible boost in efficiency!

David Kelling, CPA and President

Kelling, Bocovich & Co., LTD

1040SCAN recognizes 42 grantor letters and 22 state K-1’s whereas ProSystem fx Scan, Lacerte, and UltraTax recognize none. 1040SCAN is also the only scan-and-populate solution that extracts 100% of data from federal organizer pages. CCH, Lacerte, and UltraTax do not provide this feature at all.

In addition to recognizing many more documents, 1040SCAN is the only solution that exports margin interest, investment fees, foreign income, and over 65 other fields.

ProSystem fx Scan vs 1040SCAN

Lacerte Tax Scan & Import vs 1040SCAN

UltraTax Source Document Processing vs 1040SCAN

Available in 3 versions to meet the needs of each firm and return type.

If you only plan to adopt one technology this year, OCR provides the most straightforward return on investment. Start scanning tax documents up front to take advantage of data entry time savings.

Discover the full potential of our best-in-class solutions with a one-on-one demonstration.

Schedule a demoThough OCR saves tax professionals significant data entry time, it is not 100% accurate. Human verifiers must still check the data for errors before it exports to tax software. This was a fact of life until 2019, when SurePrep announced a revolutionary patent. Our Auto-Verification technology can eliminate the need for human verification of native PDFs.

Native PDFs are different from the PDFs you create when you scan a paper document. Native PDFs are documents downloaded directly from your clients’ financial institutions, like a 1099 downloaded from the Schwab website. You’re probably already receiving native PDFs from clients via email, your portal, or file sharing service. 1040SCAN compares the OCR extracted data to the text layer from the same area of the page and automatically verifies that the two sources match up. No human verification is needed, saving firms an entire step in the process.

Only SurePrep offers this feature. Firms that combine 1040SCAN’s built-in Auto-Verification with TaxCaddy’s Smart Links see especially steep time savings. All documents retrieved via Smart Links are native PDFs. On average, TaxCaddy client firms report that about 60% of taxpayer documents arrive in native PDF format.

Verifying OCR data takes a fraction of the time it would take to enter data manually. But if you want to optimize for maximum savings, choose the only OCR option with Auto-Verification.

One of the biggest mistakes firms make when switching to a digital process is choosing generic software. Tax workpaper preparation is highly specialized. You shouldn’t choose a generic document manager—nor software built for something else entirely, like trial-based engagements.

Generic document management systems only sort documents at the file level. What happens when one file has several pages or sheets, and each is its own workpaper? Some vendors try to tack on tax preparation tools with a plug-in. These plug-ins create more problems than they solve because they only work on specific file types. If you’re forced to convert all workpapers to PDF, what happens when you need to update an Excel formula?

There is no substitute for purpose-built 1040 workpaper software. The only workpaper management system designed bespoke for tax preparation is SurePrep’s SPbinder.

SPbinder works with all file types, so you can prepare workpapers in their original formats: PDF, Word, Excel, and email. The built-in stamps, tick marks, and other annotation tools treat all file types the same. So does the powerful cross-referencing tool, which lets preparers create one-click links between documents. For example, a preparer can link an amount referenced in an Excel sheet to its PDF source document. This makes life easier for the reviewer.

SPbinder is designed to reduce review time. Thorough annotations and hyperlinked cross-references make the binder easier to navigate. The cross-reference links even work inside SPbinder’s digital calculator tape, so every referenced amount can be sourced. The calculator tape is fully searchable, as is the workpaper index tree. Reviewers can open cross-reference links in new tabs or new windows for a multi-monitor workflow. Multi-level sign-offs and automatic change-tracking mean the reviewer knows exactly what’s changed since the last time they opened the binder.

It would be 7-10 days in peak time for a return to get through review. Now we’re looking at 3 or 4.”

Cindy Bupp, EA, Manager

Huth Thompson LLP

SPbinder comes included with all units of 1040SCAN. 1040SCAN automatically sorts your workpapers into the SPbinder index tree in an order that follows the flow of the tax return. An intuitive thumbnail panel makes it easy for preparers to click-and-drag non-standard documents into the index. Importantly, SPbinder lets preparers manage workpapers separately, even if there are several in one file.

SPbinder offers thumbnails of all document types, including PDFs, Word, and Excel. This makes it so easy to visually locate a source document, like a consolidated mortgage brokers statement.

David Kelling, CPA and President

Kelling, Bocovich & Co., LTD

SPbinder is designed to make tax workflow best practices come naturally. By giving your preparers the right tools, you’ll get thoroughly annotated workpapers with clear paper trails. This sets partners up for a quicker review. Because review is the most expensive phase of the return, shortening review time increases cost-efficiency. Switching to a 1040-specific solution this year can make a noticeable difference to your profit margins.

Who doesn’t want to get paid sooner? Your firm can make a simple change to increase client happiness and see faster turnaround on invoices. Send the finished return, 8879, and invoice through the same channel.

Many firms use a stitched solution for the delivery phase of the return. They’ll deliver the finished return through a document portal, send the client to a third party KBA service for the 8879 signature, and dispatch the invoice via mail. This creates a disjointed experience for your clients and delays invoice payment.

TaxCaddy unifies the process. Your admin pushes the completed return, 8879, and invoice to your client’s TaxCaddy account. It only takes a few clicks. Your client can download the return, sign the 8879, and pay the invoice without ever leaving the TaxCaddy app.

Already use SafeSend returns for easy one-click delivery? TaxCaddy integrates fully. See a demo video here.

Implement these 5 tax workflow best practices this year to see a transformation in your practice. You’ll reduce administrative costs, increase profit margins, and improve the client experience.

Contact one of our product experts to ask questions or schedule a one-on-one demonstration.

CONTACT SALES