Interactive Demonstration

Experience the entire SurePrep tax process from start to finish.

Transform the client experience

Eliminate the paper organizer and transform the client experience in 5 simple steps.

Phase 1

Analyze your current process

Phase 2

Organize the implementation team

Forward-thinking tax professionals are constantly searching for ways to improve their internal processes and enhance the client experience. Today’s mobile 1040 tax technology provides an opportunity to accomplish both. Hotel, restaurant, and banking are prime examples of industries that underwent a successful digital transformation by providing mobile options for their customers. These days, taxpayers expect the same technological conveniences from their trusted tax advisors.

In this whitepaper, we’ll examine how the hotel, restaurant, and banking industries adopted mobile technology to remain competitive and provide clients with more convenient services. We’ll also show you how your firm can transform the 1040 tax client experience and eliminate inefficiencies in your current process.

One of the early adopters to leverage mobile phone apps was the hotel industry, which completely transformed their operations by allowing guests to access services through their mobile devices. In fact, major hotel chains have streamlined customer interactions so that booking rooms, making changes, using keys, and check-in/out can all be completed via mobile apps. Marriott has even eliminated the front-desk check-in entirely for tech-savvy guests who wish to complete the transaction in advance.

Many restaurants have adopted mobile technologies that improve their internal processes and increase convenience for diners. In the past, patrons needed to call in and often wait on hold in order to make reservations or order take-out. There was also no way of viewing a restaurant’s menu without physically travelling to the establishment. Today, most restaurants have a full online menu along with photos and reviews that give potential customers a better idea of the food, service, and atmosphere. Apps like OpenTable consolidate all of these functions into a singular experience while also offering the ability to make reservations digitally. In addition to benefiting customers, mobile technologies free up staff by reducing incoming calls.

Banks have implemented mobile solutions in a way that most closely resembles the digital transformation that CPA firms are currently embracing. Traditionally, depositing checks and transferring funds meant a trip to the bank that required customers to wait in line and complete an in-person transaction with a teller. These days, customers of most banks have the option to photograph checks for deposit, view statements, and transfer funds from their mobile device. This new method is not only more convenient for the customer, but also far more cost efficient for the bank, as it cuts down on staffing requirements and simplifies document storage and logistics.

CPA firms have used paper-based processes to request and receive documents from 1040 clients for decades, which explains why some firms are resistant to change. With faster and more efficient options becoming available, tax professionals are beginning to depart from their old ways in order to improve efficiency. The cost of paper, envelopes, stamps, ink, toner, and time adds up considerably for firms that prepare hundreds or thousands of returns each year. Moreover, paper organizers place a burden on taxpayers, who must race against the clock to collect their own tax documents (such as W-2s, 1099s, and K-1s), sign engagement letters and statements of work, and put a finished packet in the mail on a deadline. Once the firm receives the packet, staff must spend valuable time processing the documents and keying information into tax software. This work must be performed in the office, which is a limitation in a world where remote work infrastructure has become a necessary flexibility.

Along with reducing transaction and processing costs, firms that implement new technology solutions can prepare tax returns more quickly and accurately, give employees more work-life flexibility with the option to work from anywhere, and improve client satisfaction.

While implementing a scan and populate solution or a document management system will certainly improve the firm’s internal processes, the impact on the client’s experience is minimal or non-existent, since they continue using the same paper organizer as before. Online portals are another option, but compared to the paper organizer, they offer only marginal improvement for clients, since they are not designed specifically for 1040 tax preparation. Adoption tends to be low. In terms of client experience, they leave a lot to be desired.

Other technology solutions have tried to reduce the tax preparer to a calculator. Your clients can get a calculator from anywhere. This is all about the client experience.

L. Gary Boomer, CPA, CITP, Boomer Consulting, Inc.

TaxCaddy was designed with the taxpayer experience in mind. It completely replaces the traditional paper organizer and is far more advanced than an online portal. By dramatically increasing the convenience of filling out a tax questionnaire, delivering documents, and rendering signatures, TaxCaddy allows clients to spend less time on their tax returns, which meaningfully reduces their tax season stress. TaxCaddy also reduces tax season workload compression for your staff by making it easy for clients to deliver their documents and data earlier than ever before. Read what taxpayers are saying about TaxCaddy

Providing source documents is a snap with the TaxCaddy mobile app for iPhone, iPad, and Android! In the same way checks are scanned through mobile banking apps, clients can snap pictures of paper documents and upload them as background-free PDFs that flow right into your scan and populate solution. Photo-scanning documents saves your clients time they would have otherwise spent collecting and organizing documents in a paper folder throughout the year.

TaxCaddy even provides secure, in-app messaging to maintain a strong channel of communication between you and your clients. Any missing details or outstanding questions that could create speedbumps in the tax prep process can be easily resolved.

The following is a detailed breakdown for successfully implementing a new client-facing technology and maximizing acceptance with an impressive success rate. It’s based on our experience and the Center for Project Management’s (CPM) change methodology.

Once you’ve made the decision to implement mobile tax technology for clients, it is vital to designate a project sponsor with a thorough understanding of your firm’s process and the desire to make positive changes. Strong leadership and concise communication skills are crucial for this role, as the project sponsor will be making important decisions and ensuring that the firm and clients are all on the same page. Typically, a firm partner is an appropriate candidate for this role.

With a sponsor in place, the firm should next map out a project charter to clarify management expectations. This business plan serves as a method of performing due diligence to justify why the change is being made, what the specific objectives are, and what results the firm can expect.

From there, the firm should then define the value proposition. This is a condensed pitch to sell both the staff and their clients on why this change is for the best. The project sponsor can create two separate value propositions—one for clients, one for staff—or they can form a hybrid that resonates with both parties.

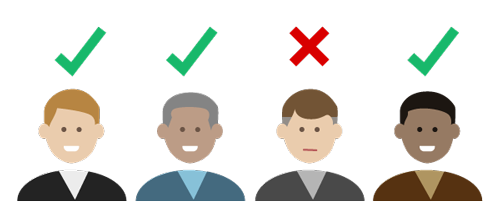

Once the entire team is on board with the project vision, the next step in the organize phase is to communicate this vision to clients. If the firm has a good strategy to convince clients that this change in technology is for the better, the acceptance rate will be high. Some firms have seen a client acceptance rate of 95% or more. That’s why it’s crucial to have a structured implementation outline in place before officially rolling out the new software.

SurePrep’s own Client Success Management team uses these tried and true methods to ensure success for firms of all sizes.

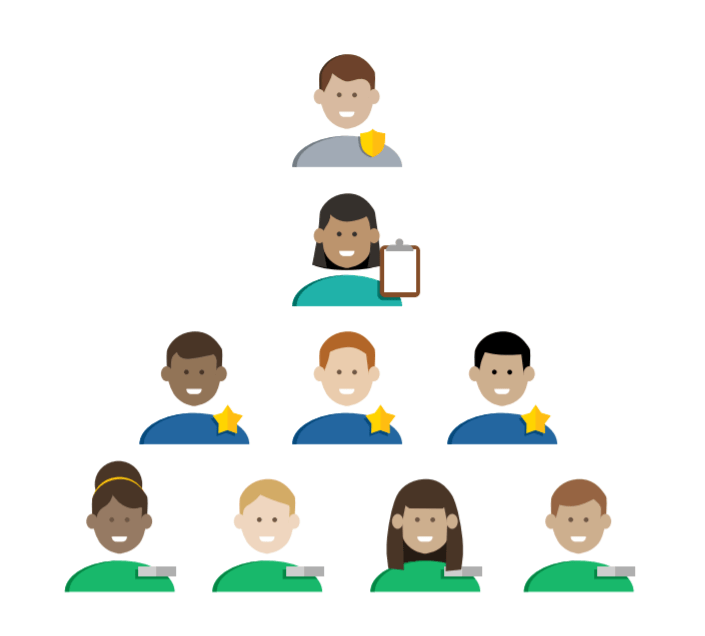

In order to ensure a successful 1040 mobile tax technology implementation, it’s important to assemble a solid team with well-defined roles and the chemistry to facilitate collaboration. At the forefront is the aforementioned project sponsor with decision-making authority and a clear vision for how they want to accomplish the implementation process. Below the project sponsor is the project manager: a more hands-on leader who deals with day-today operations and is available to answer questions and provide assistance. In the third tier, implementation advocates are typically selected from different departments to ensure that adequate knowledge of the project is spread throughout the entire firm. For example, it would be ideal to have one advocate in administration, one in preparation, and one in review. At the base of the pyramid, the general staff communicate with the advocate in their respective departments to form a proper understanding of the change that is taking place.

Once the entire team is on board with the project vision, the next step in the organize phase is to communicate this vision to clients. If the firm has a good strategy to convince clients that this change in technology is for the better, the acceptance rate will be high. Some firms have seen a client acceptance rate of 95% or more. That’s why it’s crucial to have a structured implementation outline in place before officially rolling out the new software. SurePrep’s own Client Success Management team uses these tried and true methods to ensure success for firms of all sizes.

After the plan has been finalized and a foundation of knowledge has been established within the firm, it’s time to execute the rollout of your mobile 1040 tax technology. To preserve a healthy and professional relationship with clients, we recommend informing them of the upcoming change two months before the official implementation. Additionally, the firm should be prepared to give a compelling explanation of why this change is being made. With TaxCaddy, the pitch is simple: “We want you to spend less time on your tax return this year, and more time on the things that matter most to you (family and friends)! That’s why we’ve decided to provide you with mobile-enabled technology that fits your modern lifestyle and allows you to collaborate with us quickly and efficiently.”

When TaxCaddy goes live, clients will be able to set up their accounts and begin using the software. Expect some clients to have questions. This is where a well-structured organization plan shows tangible benefits, as it gives staff a road map for directing questions and delegating internal resources, which results in fast, exceptional service for clients.

Once the new mobile 1040 tax technology has been implemented, firms should regularly follow up with clients to ensure these solutions have staying power. SurePrep always schedules a post-tax season meeting with clients to identify any challenges and formulate plans for fine-tuning implementation. Gathering feedback and making needed adjustments is important for the longevity of any technology solution.

After the first tax season, firms will develop a good feel for the benefits, challenges, and expected ROI that come with the switch.

A key indicator of organizational maturity is the ability to adapt when needed. The best approach is a bold one that lays thorough groundwork to make transition effective and worthwhile. Partial change may seem safer up front, but it will only lead to issues further down the road. A committed, “all in” approach has the highest success rate. This philosophy is especially important when implementing technological change—particularly client-facing technology. TaxCaddy users have responded very positively, finding it quicker, more convenient, and more flexible than the traditional paper organizer. In research collected by TechValidate, a third-party survey provider, 97% agreed with the following statement:

By offering technology options like TaxCaddy, my tax professional demonstrates that he/she wants to improve my experience as a client.

In today’s world, your clients expect the same time-saving technological conveniences they receive from banks, hotels, airlines, restaurants, and various financial service providers. Streamlining your 1040 taxpayer collaboration with TaxCaddy is a terrific way to increase your firm’s efficiency and improve client service.

However, it’s important to properly plan the implementation of any mobile 1040 tax technology before the official rollout. By following the above five-phase approach, you’ll establish the proper groundwork to achieve an excellent adoption rate and impress your client base for years to come.

SurePrep will be with you to provide support at every step along the way. Join three of the Big 4, seven of the Top 10, over half of the Top 100, and nearly 1,000 small to mid-sized firms who have transformed their 1040 tax return workflow and improved the client experience with SurePrep.

Discover the full potential of our best-in-class solutions with a one-on-one demonstration.

Schedule a demoContact one of our solutions experts to answer questions or schedule a one-on-one demonstration.

CONTACT SALES