Interactive Demonstration

Experience the entire SurePrep tax process from start to finish.

More and more, people are becoming dependent on their mobile phones to handle their daily activities. Things like purchasing event tickets, ordering food for delivery, hailing rides, depositing checks and much, much more can all be done via mobile phone apps.—

According to Pew Research, 77% of Americans currently own smartphones and that number will only continue to increase as time goes on. These are the results of the study, broken down by category:

ages 18-29 = 94%, ages 30-49 = 89%, ages 50-64 = 73%, ages 65+ = 46%.

Today, taxpayers expect convenient, mobile options from their CPA like they do from other financial service providers like banks and brokerages. Rather than snail-mailing a stack of documents or going through the time-consuming scanning process, it’s becoming increasingly common for taxpayers to email photos of source documents. They do this because it’s easy. Unfortunately, this causes a number of issues for tax professionals:

Clients will prioritize their own convenience over what’s best for their CPA nearly every time. That’s why SurePrep has developed a solution to simplify tax time for you and your clients.

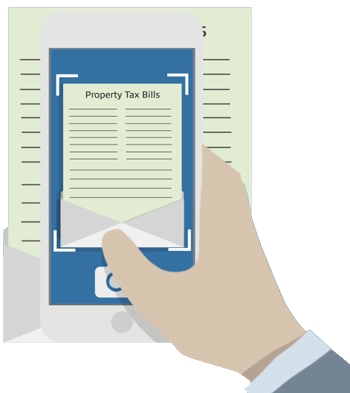

The banking industry dealt with a similar dilemma during the transition to the digital age. Years ago, banks began allowing customers to deposit checks electronically. However, they foresaw the complication of receiving blurry, poorly lit photos of checks that are barely legible. To prevent this issue, banks developed mobile apps with the ability to control the image quality. This function ensures the image is in focus, eliminates the background of the photo and minimizes the file size.

You can still drive to a bank branch and walk up to a teller, but ever since giving clients digital options, banks have substantially reduced the administrative costs that comes with handling deposit transactions. Moreover, by automating the process they greatly reduced the number of in-person transactions without losing any business. Some banks have even reduced the number of physical branches while maintaining the same amount of business, resulting in tremendous savings.

TaxCaddy is SurePrep’s solution to tackle similar issues in the 1040 tax return industry. Taxpayers can deliver their documents to you in a manner that is extremely convenient for them while providing you the security and quality control that makes your tax return preparation process highly efficient. It’s a win for you and a win for your clients.

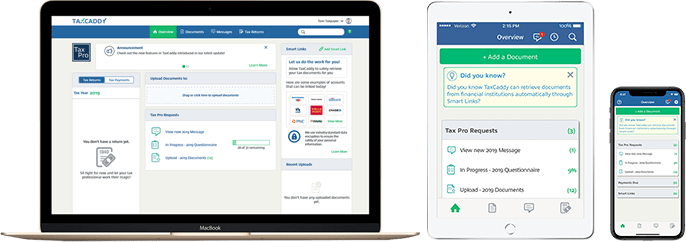

On the taxpayer’s end, TaxCaddy provides a simple and functional interface. The homepage gives a generalized overview of the features, and users can access Tax Pro Requests and Smart Links along with a one-click document uploader.

Within the Tax Pro Request section, the process begins with a customized questionnaire to give CPAs answers to the questions they need to prepare the tax return. Feedback has shown that users strongly prefer digital questionnaires that can be completed on the go as opposed to filling out a paper or online form.

For documents that need to be signed, such as engagement letters, statements of work and the e-file authorization, TaxCaddy offers an easy to use e-signature feature.

In addition to quickly signing documents, clients can deliver the requested documents in three easy ways.

Taxpayers can also mark requested document as “already provided” or “does not apply”. In instances where the taxpayers doesn’t have the requested document because it’s provided by the CPA, like a K-1, the tax professional can upload it to TaxCaddy on behalf of the client.

If the request list is missing documents that the client believes are relevant, clients can select “I have other documents that aren’t listed here,” which allows them to upload tax information that was not asked for but may be vital to the return. These documents can also be uploaded from the home page under the generalized “+Add a Document” button. From there, users select from a list of document types to classify the file and are given the option to sort by “Popular” or “All” in order to speed up their search. After selecting the document type, taxpayers can fill in subcategories and TaxCaddy will suggest a name for the file, leaving the option open to change it. Once the category is selected, the process is complete and the document is uploaded.

If your clients email you photographs of documents they’ll love TaxCaddy app for iPhone and Android. TaxCaddy’s photo-scanning function creates the best scan-quality PDFs possible. The app informs users to hold the phone still and automatically captures the image once the document is clear and within the borders. With the background eliminated from frame, users are then given the option to retake the photo, edit it or continue taking photos of additional pages. Since TaxCaddy uses banking security protocols like 4096-bit Secure Socket Layer encryption, document transfers are secure. Say goodbye to documents being delivered to you via unsecure email.

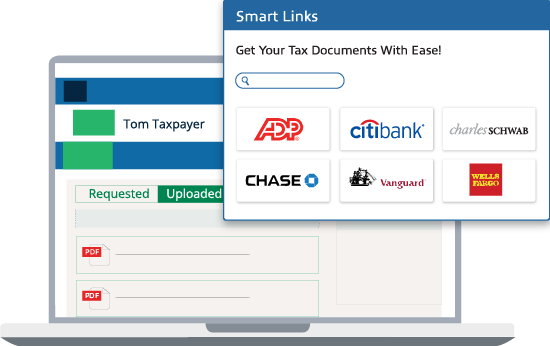

Another convenient and time saving feature in TaxCaddy is Smart Links. Smart Links automatically retrieve tax documents without requiring you or the client to lift a finger. Once the taxpayer links their banks, brokerages and payroll service provider, TaxCaddy checks for new source documents once per day and automatically uploads them to the document request list as soon as they become available. Documents retrieved through Smart Links are always in native PDF format, which means 1040SCAN can auto-verify the OCR data.

To maintain a productive stream of communication between the firm and client, taxpayers can securely message the CPA through TaxCaddy with any questions or concerns. For the sake of clarification, messages may be linked to specific documents that the question pertains to and the message recipient can be notified immediately.

For the reasons listed above and more, TaxCaddy users have expressed very high levels of satisfaction in TechValidate surveys. SurePrep utilizes TechValidate as an independent 3rd party survey provider to collect information about user’s experience. The feedback has been overwhelmingly positive. Following are some examples.

Scanning tax docs was great. The TaxCaddy app made it very easy.

TaxCaddy user

Unlike paper organizers and online portals, TaxCaddy is designed with taxpayers in mind. Since TaxCaddy is convenient and saves time, your clients will want to use it. And the more clients use it the greater the benefit to your firm.

Being able to take pictures of my documents and automatically upload them into the correct category with the TaxCaddy iPhone app was a game changer! The whole process is so easy and makes tax prep a breeze.

TaxCaddy user

TaxCaddy was very easy to use and a great improvement over having to scan documents into a PDF and upload into a client portal. The ability to take a photo and submit it immediately was especially useful. Saved me a lot of time over the methods we used with our tax professional in the past.

TaxCaddy user

It was simple, less stressful and very convenient.

Lev L’vov, TaxCaddy user

Tax season was much easier and less stressful. I will be happy to use it next year.

Lisa Roll, TaxCaddy user

Easiest year I’ve had in the last 5 years

TaxCaddy user

I absolutely… loved using TaxCaddy! The way it was organized allowed me to see what is missing.

TaxCaddy user

Firms have seen roughly 40% adoption in year one and continual growth from there. Improving client experience is the most surefire way to improve your business and TaxCaddy is the opportunity for CPA firms to “Wow” their clients.

Smart phones aren’t going anywhere. In fact, their overwhelming popularity with younger generations indicates that they’ll only continue to be solidified as the go-to technological platform. Supplying mobile options for clients will soon become a necessity and TaxCaddy gives your firm the opportunity to stay ahead of the curve.

With TaxCaddy, your firm has a simplified interface to streamline the gathering and delivery of tax information while impressing clients along the way. Firms that embraced TaxCaddy have seen an estimated 40% adoption in year one and continual growth from there. Providing an excellent client experience is a surefire way to improve your business, and TaxCaddy allows your firm to cater to the customers of tomorrow.

Contact one of our product experts to ask questions or schedule a one-on-one demonstration.

CONTACT SALES