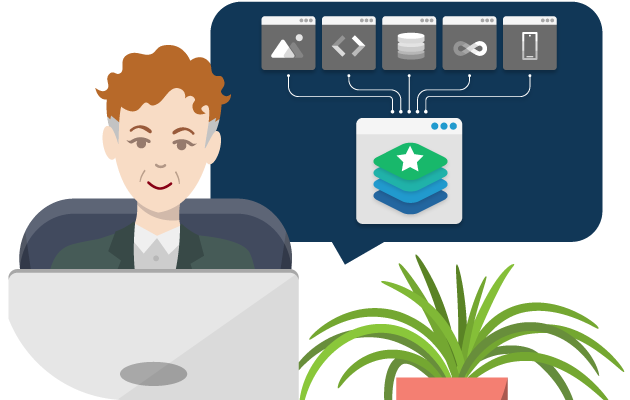

Do you know how many Software as a Service (SaaS) apps your firm uses? Some of your software adoption could actually be counterproductive to your firm’s goals.

Combining dispersed, poorly integrated software leads to “SaaS sprawl” and its associated issues:

Our product experts can diagnose how your 1040 tech stack is performing and recommend strategies to increase integration and efficiency. Schedule a no-obligation consultation to see how your firm can address SaaS sprawl and maximize productivity.

Contact Sales

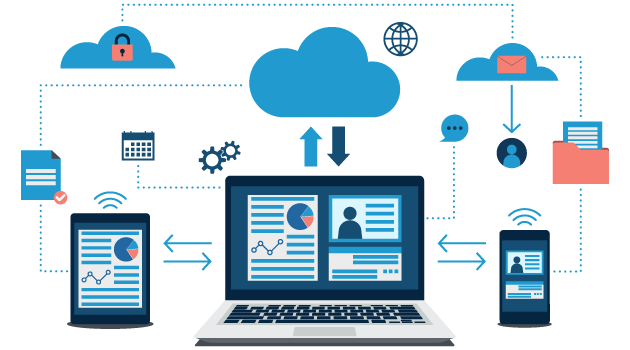

In 2020, tax professionals across the globe were forced to go remote with limited notice. This prompted an industry-wide scramble for cloud-based SaaS applications without the usual vetting and implementation protocols.

Today, many firms are realizing they’re overspending on ill-fitting workflow software. In a profession where standardized, consistent processes are foundational, this form of digital clutter can be especially harmful.

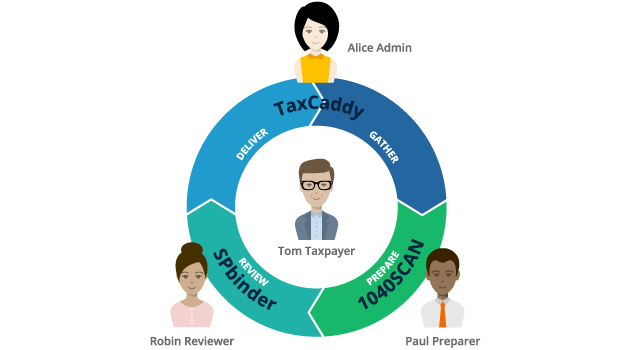

Learn MoreSurePrep technology streamlines the 1040 tax process. Three cloud-based solutions integrate with tax software to automate preparation, reduce review time, and enhance the client experience. How do you want to work?

At every stage of the 1040 workflow, SurePrep is there to optimize and assist.

Three of the Big 4, seven of the Top 10, fifty-eight of the Top 100, and approximately 2,000 small- to mid-sized firms use SurePrep solutions to automate their 1040 tax workflow.

Is your process compatible with SurePrep? Our solutions work best for firms that collect client information up front and process returns without requiring clients to visit the office.

Our product experts will share insights on proven ways your firm can: