Maximize client adoption of your firm’s 1040 technology initiatives

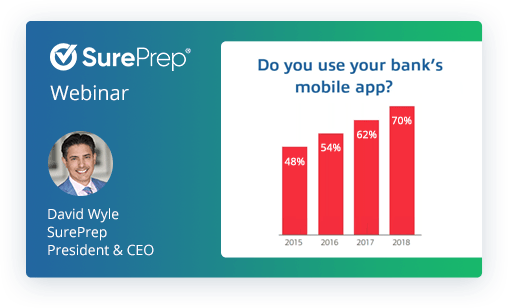

“Consumers prefer mobile apps over computers” and “90% of consumers prefer to manage their finances all in one place,” according to the Chase Digital Banking Attitudes Study. The popularity of centralized mobile banking suggests that accounting firm clients want a similar experience for their taxes. Here are best practices for onboarding your entire client base—even those resistant to change—to a modern collaboration process.

CPE credit is available for live CPAacademy sessions only.

Register