Millions of new investors and traders entered the world of cryptocurrency in the past year. Now, many of them may need guidance reporting crypto activity on their tax returns. If your firm has never processed crypto tax returns in the past, you could be looking for some clarity as well.

It’s time to find out which tax documents you’ll need for cryptocurrency clients and how to calculate their information.

Key documents for your client’s crypto tax return

To report cryptocurrency on their 1040 tax return, your client will need to provide their complete transaction history on all exchanges and wallets used throughout the tax year. Advanced users will often trade on multiple exchanges and own more than one wallet, so the preparer may need to reference several sources.

Exchanges are required to supply users with a 1099-B, 1099-K, or 1099-S that documents their proceeds. 1099-B provides information about individual transactions, which makes it easier to establish cost basis, while 1099-K and 1099-MISC do not. The preparers will need to cross-reference a separate transaction report if your client’s exchange does not provide a 1099-B.

Major crypto exchanges allow users to export their transaction report as a downloadable CSV file. When exchanges don’t include this reporting feature, users must document their transactions manually. Exchanges that do provide transaction reports don’t always save data for the entire tax year.

Even if your client’s exchange does provide a 1099-B, your preparers may still need to cross-reference other transaction reports if your client trades on multiple exchanges. For example, if your client buys crypto on Exchange A, transfers the crypto to Exchange B, and sells for fiat currency on Exchange B, then Exchange B’s 1099-B would lack information about the crypto’s acquisition costs.

In cases where cost basis is impossible to establish, the preparers will need to follow special instructions on Form 8949.

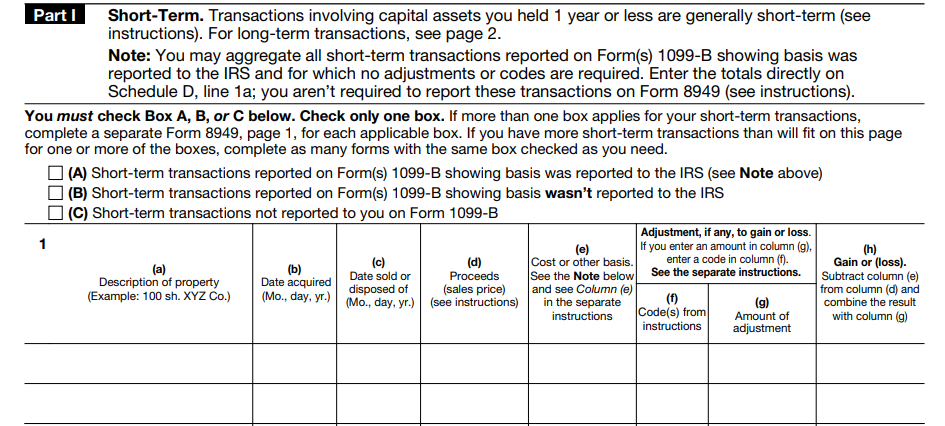

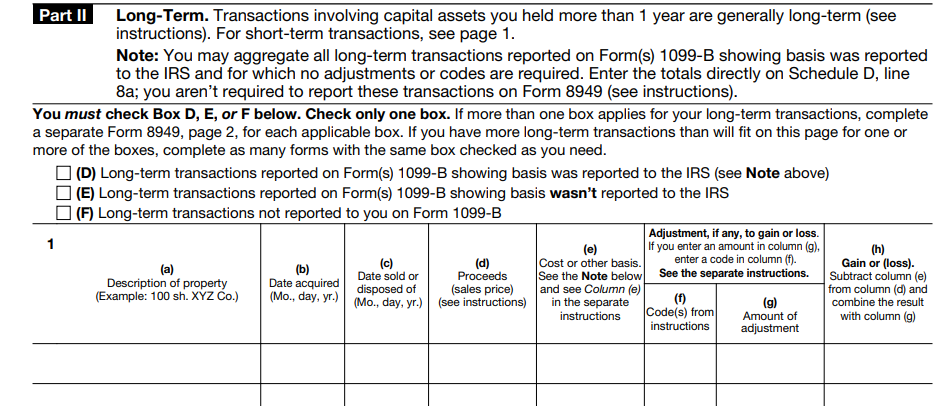

Reporting crypto activity on Form 8949

As with any capital asset, crypto activity must be reported on Internal Revenue Service (IRS) Form 8949 and Schedule D. On Form 8949, the preparer will need to record:

- When a cryptocurrency was purchased and its purchase price

- When a cryptocurrency was sold and its sale price

The length of time your client holds cryptocurrency determines how much it will be taxed. Your client must report a short-term gain if their cryptocurrency increased in value from its purchase price and they held it for less than one year. Cryptocurrency held for longer than one year qualifies as a long-term asset and is eligible for long-term rates.

IRS: Form 8949

On Form 8949, your client must report short-term gains under Part 1 and long-term gains under Part 2. Some extra notes to consider:

- If cost basis information is available to your preparer, check box “A” for short-term assets and “D” for long-term assets.

- If the cost basis information is not available, check box “B” for short-term and box “E” for long-term.

- If the exchange has failed to issue a 1099, checking box “C” for short term and “F” for long term indicate that gains and losses are self-reported.

Calculating gains and losses for cryptocurrency

Cryptocurrency is treated as property for federal income tax purposes, according to the IRS. Calculating gains and losses for crypto follows the same formula as traditional capital assets.

(Proceeds – Fees) – (Purchase Price + Fees) = Gain/Loss

Once the preparers have reported these calculations on Form 8949, they can transfer the totals to the corresponding section on Schedule D.

Automatically generate Form 8949 with tax technology

Reporting crypto on tax returns follows the same procedure as any other capital asset. However, obtaining the necessary tax information for Form 8949 isn’t always as easy.

Smaller crypto exchanges may provide reports that don’t span the full tax year. Other reports don’t show the fair market value at the time of a transaction. To make matters worse, there is no standardized format across exchange reports. For these reasons, tax professionals have embraced technology to address information gaps and automatically generate Form 8949.

Learn how SurePrep and CoinTracker can simplify your crypto tax return in our recorded webinar, Nuts & bolts of cryptocurrency taxes.

View WebinarDisclaimer: The information contained within this document is provided for informational purposes only and is not intended to and must not be taken as a substitute for obtaining accounting, tax, legal, or other professional advice from a tax professional (e.g., an Enrolled Agent, CPA, attorney, etc.). No warranty or representation, express or implied, is made by SurePrep, part of Thomson Reuters, nor does SurePrep, part of Thomson Reuters, accept any liability with respect to the information and data set forth herein. Distribution hereof does not constitute legal, tax, accounting, investment, or other professional advice. You should consult a professional advisor and/or legal counsel prior to acting on the information set forth herein.