Digital transformation reduces friction and delivers a modern 1040 client experience

Solutions in Focus: TaxCaddy, 1040SCAN, SPbinder

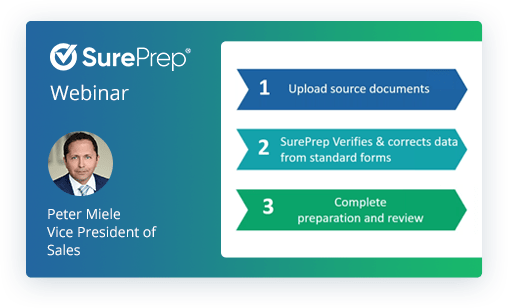

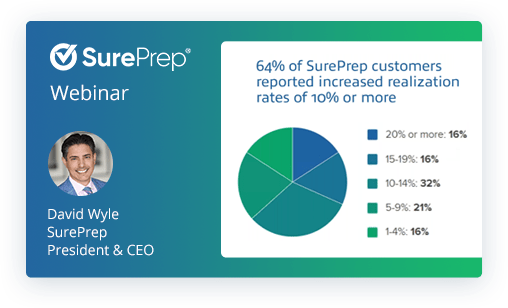

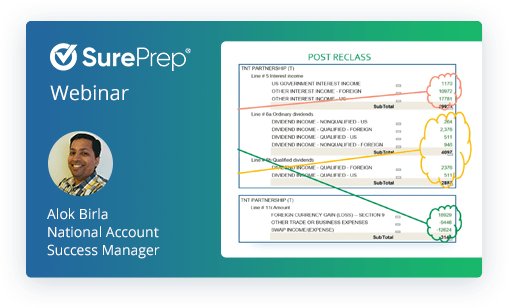

Robotic Process Automation, mobile apps, dashboards, and next-generation scan-and-populate technologies are reducing friction and streamlining workflows at unprecedented rates. In this session, you’ll learn how these technologies enable firms to work remotely, receive source documents the day they’re issued, eliminate data entry, increase profitability, and delight 1040 clients.

Going paperless concentrates solely on reducing paper and the benefits that come with that. Digital transformation also reduces paper, but its ultimate goal is rather to reduce friction. It embraces more technologies in order to digitize more processes.

David Wyle, SurePrep

CPE credit is available for live CPAacademy sessions only.

View Webinar