Tax and accounting firms of all sizes can increase workflow efficiency by leveraging automation technology as virtual tax preparer assistants.

Jump to:

- How technology simplifies tax preparation

- How technology elevates preparers

- Technology as a tax preparer recruitment assistant

- What’s the best automation software for professional tax preparers?

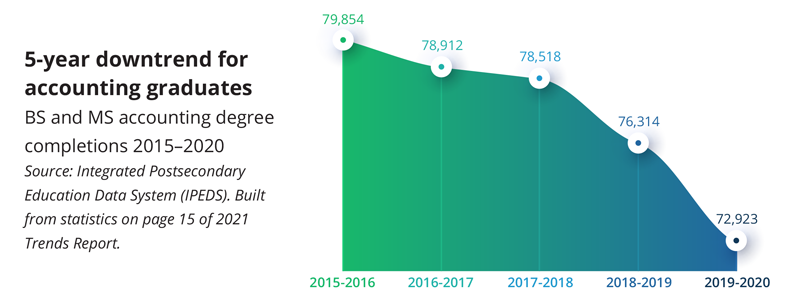

Industry-wide staffing shortages have put qualified tax professionals in historically high demand. Many firms that used to rely on seasonal tax preparer assistants are now struggling to find temporary help. Future projections are even less encouraging because accountants are retiring at a much faster rate than new graduates entering the field.

Don’t worry; this doesn’t spell doom for the tax and accounting profession. AI and other recent advancements in tax automation have made it possible for firms to supplement labor they can’t find in the workforce.

Leveraging technology to eliminate time-consuming preparation tasks means…

- Firms can prepare more returns with fewer staff members.

- Tax professionals have more time for higher-value work, like financial advising.

- Firms gain a competitive edge when recruiting from today’s smaller pool of candidates.

You might be surprised at how many ways the right technology can serve as a virtual tax preparer assistant for your firm.

How technology simplifies tax preparation

Tax preparers spend too much time inputting data and indexing binders. They could make a greater impact by concentrating focus on detailed workpaper documentation—even first-line review.

Unfortunately, staffing constrictions have placed additional workload demands on preparers. Many lack the bandwidth to hone their expertise because manual tasks consume most of their time. That’s why tax technology is no longer a luxury for many firms, but a necessary tool to get true value out of their staff.

Here are three examples of how 1040 solutions can assist tax preparers in managing their workload.

Eliminating data entry

Scan-and-populate software extracts data from client documents and exports it to your tax software so preparers don’t have to enter it manually.

While this technology is hardly new to the accounting industry, some products have made tremendous strides in document recognition while others have remained stagnant. Investing in the right solution can make a considerable difference in your preparers’ capacity to take on additional work.

Explore our document coverage comparison charts to see how the top 1040 scan-and-populate solutions stack up.

Eliminating OCR verification

Optical Character Recognition (OCR) is the technology that makes scanning and transposing document data possible. But while OCR has seen considerable strides in accuracy, even the best solutions aren’t flawless. That’s why it’s best practice to validate extracted data for accuracy before exporting.

Although human verification is far more efficient than manual data entry, it still consumes time that could be better applied elsewhere. Fortunately, emerging technologies can now assist tax preparers by auto-verifying OCR data. 1040SCAN uses patented text-layer matching and Artificial Intelligence (AI) to automatically verify OCR data on 65% of standard documents. No other solution on the market offers this patented technology.

Automating workpaper organization

Before workpaper preparation can begin, documents need to be bookmarked and organized into an index that makes sense to preparers and reviewers.

1040SCAN integrates with SPbinder to do the job for you. Before a team member even touches the binder, it’s already bookmarked and fully indexed. This allows preparers to immediately begin work on creating well-documented workpapers that are easy to review.

How technology elevates preparers

Spending the bulk of your preparers’ hours on data entry and verification not only limits your firm’s potential, but your staff’s career ambitions.

“No one went to college, studied accounting, and passed their CPA exam to copy a number from Box 3,” said Steven Hart, Chief Information Officer at Janover LLC, on the topic of 1040 automation. “This allows us to teach them what different values in Box 3 mean and what needs to be considered.”

Spending less time on these manual, repetitive tasks gives preparers more opportunities to apply their true accounting expertise. Instead of bookmarking and indexing workpapers, your preparers could be marking them up with calculator tape and annotations to simplify review. Concentrating on higher-level work helps preparers deliver more value to your firm and allows them to expand their professional resume.

Technology as a tax preparer recruitment assistant

For firms that struggle with staffing, work-life balance can seem impossible during busy season. The long, stressful hours associated with accounting contribute to the industry’s high turnover rate and its self-perpetuating cycle of staff burnout.

Automation offers tax professionals much-needed relief, which can be a key differentiator in recruitment. When two assistant tax preparer openings offer the same salary with vastly different workloads, the choice is simple for job seekers. With competition for talent at an all-time high, your tech stack could be what sets your firm apart.

What’s the best automation software for professional tax preparers?

Automation offers a solution to the staffing and workload compression challenges facing the industry—but not all automation solutions are created equal. SurePrep leads the industry in 1040 tax technology. Our solutions provide automation relief to firms of all sizes, from three of the Big 4 to sole practitioners and everything in between.