Workpaper management software is an essential part of the tax and accounting tech stack. Choosing the right technology can enhance efficiency and accuracy in the tax workflow process.

It’s every firm’s goal to create well-documented workpapers that facilitate a smooth and efficient review. To accomplish those tasks in the digital age, firms need the right workpaper management software.

Modern workpaper management software for tax engagements can perform three core functions:

- Automatically organize digital workpapers into an indexed binder

- Provide tools to enhance preparation and review

- Store prior-year returns in a secure cloud environment

Here’s how the right tax document management system can streamline preparation and review for your firm.

How workpaper management software organizes documents

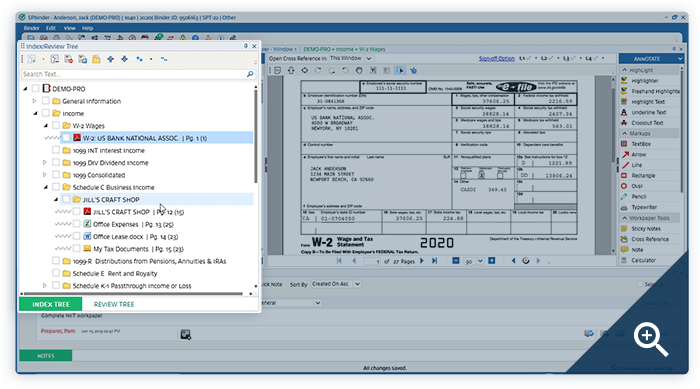

Advanced tax automation solutions like 1040SCAN bookmark and sort documents into a standardized index that follows the flow of the tax return. For example, it may group all W-2s together and place that grouping within a folder labeled “Income.” That workpaper index appears in your workpaper management software, usually as a standard folder tree.

Not all workpaper management systems are compatible with auto-indexing solutions. Some require preparers to sort and bookmark workpapers manually, while others export workpapers as one large PDF. This defeats the point of digitization because flexibility and convenience are lost.

Automated indexing of individual workpapers saves preparers time and enables faster binder navigation during review.

Preparing and reviewing with workpaper management software

Without tax-specific preparation and review tools, your workpaper management software would just be another document manager. Choosing a solution specifically designed to accommodate 1040/1041 engagements will enhance your ability to annotate, collaborate, and review. Here are features and functionalities you should look for:

- Annotation tools: Tick marks, stamps, highlights, calculator tape

- Collaboration tools: Notes, change tracking, multi-level sign-off ability

- Review tools: Digital leadsheets, change alerts, hyperlinked cross-referencing across multiple file types

You should also consider whether your workpaper management software allows file types to retain their original properties. For example, if one of your workpapers is an Excel file, will you still be able to edit your formulas from inside the workspace? Or will you be forced to convert your Excel file to an inert PDF? A robust tax document management system will preserve the editable properties of Word and Excel files.

Digital storage with workpaper management software

Instead of digging through filing cabinets, cloud-based workpaper management software allows you to access files instantly.

Users can access information from any authorized workstation. Multiple users can collaborate on the same binder without versioning issues. Pay special attention to SOC compliance and encryption standards when evaluating cloud-based solutions.

Tax document management systems should make it easier to manage client relationships year-over-year. SPbinder includes a rollover feature that populates next year’s binder with the appropriate document placeholders, as well as any specific workpapers you choose to roll over.

Digital storage saves time, effort, and paper. Your staff will thank you for switching to a digital file room —as will mother nature.

Workpaper management software integrations

There are three major integrations to consider when evaluating workpaper management software:

- Tax software. Can you import/export data to and from your tax software? If you need to adjust amounts during preparation or review, can you sync changes both ways, or do you need to copy the changes over manually? Can you import your tax software’s calculations so all review tasks can take place in one interface?

- Scan-and-populate. Can your scan-and-populate solution send digital workpapers directly to your workpaper management software? Can you view/edit the Optical Character Recognition (OCR) data captured by the scan-and-populate solution inside the workpaper system?

- Taxpayer collaboration platform. Is there a direct pipeline between the documents your clients submit and your workpaper management system? Or do you need to manually track document deliveries, save the documents offline, and import them to continue your workflow?

Another way to look at the integration question is to ask, “Is my tax automation workflow integrated from end-to-end?” If there’s any step in your 1040 process where integration drops off and manual workarounds are required, then there’s room for improvement.

Learn how an end-to-end digital tax workflow can help your firm by reading our e-book, Why is digital transformation important for your firm and 1040 clients?

Download E-Book