Interactive Demonstration

Experience the entire SurePrep tax process from start to finish.

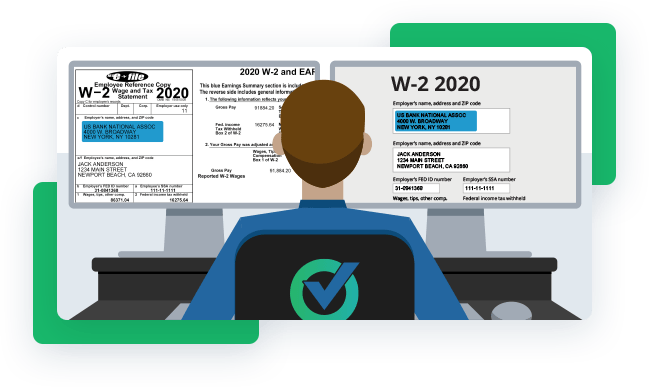

1040SCANverify is available as an alternative to full outsourced tax return preparation services and offers 80% of the work for 20% of the cost. Contact our team to find out which of these solutions is right for you or learn more about 1040SCANverify.

Finding qualified staff can be difficult—and training new hires while tax season ramps up is even more inconvenient. Outsourcing tax preparation to an experienced team with quick turnaround time helps you prepare more returns without hiring additional team members.

Firms of all sizes understand the hectic and stressful nature of tax season. Outsourcing even a portion of your tax preparation workload can help make peak season more manageable. Our staff uses the same tax software as your firm, so you can jump right into review as if your own staff prepared the return.

Think of SurePrep staff as the preparers in your office. You can track the status of each outsourced return as SurePrep prepares it. With the time saved by eliminating preparation, you can concentrate on providing other value-added services to your clients.

SurePrep’s outsourced tax preparation services are available year-round. Pricing is based on the complexity of each return. Our preparers use CCH Axcess™ Tax, GoSystem Tax RS, Lacerte, UltraTax CS, and Virtual UltraTax CS. SurePrep’s outsourced preparation service includes our award-winning workpaper system, SPbinder. SPbinder’s sign-offs, cross-references, annotation tools, and leadsheets allow you to review your tax workpapers in a completely paperless environment.

Looking for ways to stretch your outsourcing budget? SurePrep offers both onshore and offshore outsourced tax preparations services. Our preparers in California and India are SurePrep employees who undergo the same rigorous training. Both onshore and offshore offices follow strict security protocols, including monitored premises, locked terminals, no-cellphone policies, and employee background checks. Deliver results with confidence.

Contact one of our product experts to ask questions or schedule a one-on-one demonstration.

CONTACT SALES