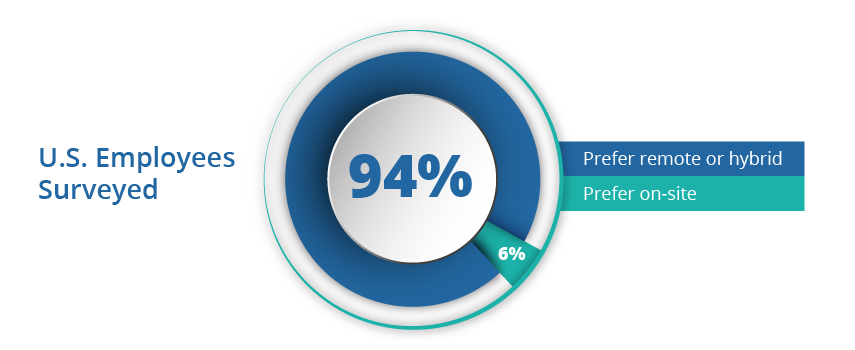

Of the 8,090 remote-capable U.S. employees surveyed by Gallup in June 2022, only 6% preferred to return to the office. The other 94% preferred hybrid or remote work, and 60% of remote workers indicated they were “extremely likely” to seek employment elsewhere if their employer terminated remote arrangements.

The traditional office is never coming back. The question now is whether to spend resources fighting the new normal—or adapting to it.

The tax and accounting industry is uniquely situated to thrive in this new environment. Tax practice workflow software that enables encrypted cloud collaboration already exists. Many other industries are scrambling to develop solutions or cobbling together disparate software. Tax preparation is also inherently remote-capable, which means it’s primed to attract a new generation of workers. Only firms that invest in remote infrastructure will reap the benefits.

You need these 3 things to build your remote 1040 workflow

According to Productiv’s The State of SaaS Sprawl in 2021 report, companies now use an average of 254 SaaS apps—or 30 to 40 apps per team. The pandemic is largely to blame; companies scrambled to digitize and got stuck with scattered processes.

How many apps do you use to prepare 1040s? One for bookmarking workpapers? One for annotations? One to collect e-signatures? Another to invoice? One to share files?

These apps don’t integrate, which creates gaps in your remote tax workflow. The complexity also creates confusion for both taxpayers and tax professionals.

Thankfully, you don’t need 254 apps to create your hybrid 1040 practice. Aside from your tax software, you only need three:

- A taxpayer collaboration platform

- Digital workpaper automation

- A cloud-based tax preparation binder

You can get them all in one place. SurePrep is the industry leader in 1040 tax automation technology. When the pandemic hit, our customers had all the tools they needed to make a quick pivot toward a remote tax workflow.

In the next few sections, we’ll show you how our tax practice workflow software moves the 1040 process into the cloud. Everything integrates to create a seamless hybrid tax office.

TaxCaddy: Your taxpayer collaboration platform

Your 1040 workflow starts and ends with the taxpayer, which means they need to be part of your remote strategy. Home ownership of printers and scanners has declined, which means that paper-handling may require a trip outside the home. Mailing certainly does. Without “from home” options, your clients will procrastinate and create workload compression for your team.

If paper is part of your process, you’ll also need admins on-site to handle mail and scan documents. Unless admins are part of your cloud-based collaboration space, your tax office workflow is not truly remote-ready.

TaxCaddy brings both taxpayers and admins into the remote fold. It gathers everything you need to collaborate with taxpayers in one place:

- Tax document gathering

- Questionnaire

- E-signatures (including KBA)

- Secure messaging

- Invoicing

- Tax return delivery

- Tax payments

TaxCaddy is available as a mobile app for iOS/Android and via browser. The mobile app is key. Fitting into taxpayers’ modern lives (read: their pockets) invites high adoption rates. Your admins, in turn, can manage client relationships from home as needed.

INTEGRATION: When a preparer is ready to start a return, they click Create Binder in the client’s TaxCaddy profile to route documents into 1040SCAN.

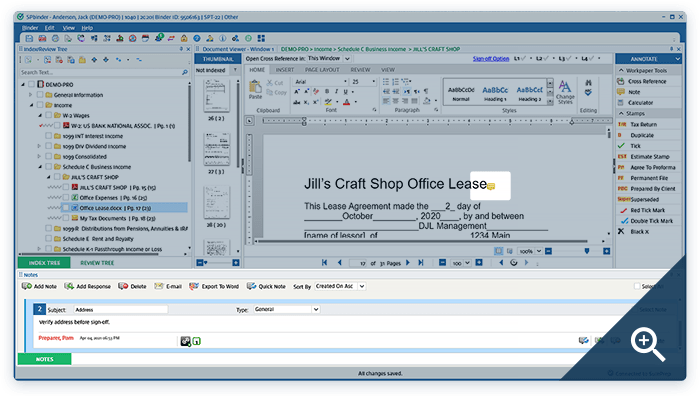

1040SCAN: Digital workpaper automation

You’ve gathered digital documents through TaxCaddy. Normally, someone would need to sort through those documents, assemble binders, and enter the data into your tax software.

1040SCAN automates these tasks. First, Optical Character Recognition (OCR) extracts data and exports it to your tax software. Then, 1040SCAN automatically sorts your digital workpapers into a standardized index tree. Documents stay in their original format. Your staff no longer need to waste time converting workpapers to PDF or painstakingly creating bookmarks with an Adobe plug-in. (Another app subscription you can cancel!)

The only thing your staff need to do is a quick verification of the data before it exports to your tax software. 1040SCAN’s AI engine auto-verifies OCR data for 65% of standard documents, so there is little left to do. Trained SurePrep staff will happily take this task off your hands with our optional verification add-on service.

INTEGRATION: 1040SCAN automatically creates an SPbinder file, where your workpapers populate a standardized index tree that follows the flow of the tax return.

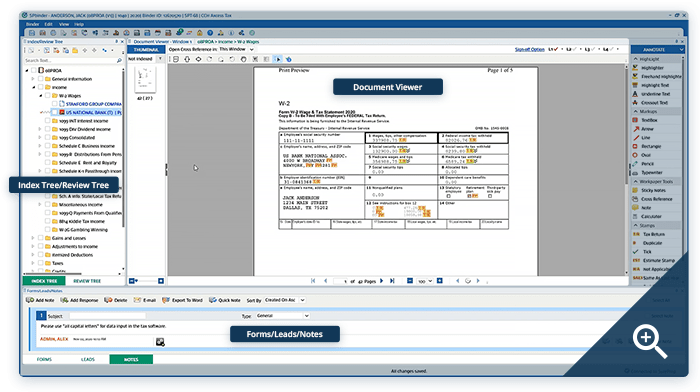

SPbinder: Your cloud-based tax preparation binder

SPbinder is the only tax practice workflow software specifically designed for 1040s. It will be the cornerstone of your virtual collaboration space.

SurePrep binders live in the cloud and changes save after every user session. You can enable up to four role-based sign-off levels, which ensure that every workpaper passes through the right pair of hands.

Working out of the same cloud-based files is critical to your remote 1040 workflow. If you pass files back and forth via email or a generic storage option (e.g., Dropbox), you’ll never know which file is current. Two people might work on the same file at the same time and overwrite each other. SPbinder protects you from these versioning issues and leaves a clear paper trail of every edit.

Everything you need to prepare and review workpapers lives in the same program. Your preparers can mark up workpapers with annotations, stamps, calculator tape, notes, and more. Hyperlinked cross-references make it easy for preparers to link amounts to their source. When it’s time to review, simply flip over to the Review Tree tab for an automatically generated list of review items.

If a preparer makes changes in the binder since your last review, the item will reappear in your Review Tree the next time you open the binder. A change alert icon will appear next to affected amounts.

Keep communication flowing in SPbinder Notes

SPbinder Notes is your virtual collaboration hub. Notes appear at the bottom of your workspace by default, but are easy to detach and maximize on a second monitor. Here, everyone who touches the binder can participate in message threads and resolve questions. You can link Notes to specific points on one or multiple workpapers, so everything stays in context.

All open Note threads stay visible in the Review Tree until an authorized user marks the Note as cleared.

SPbinder’s centralized approach will ensure a standardized remote 1040 workflow, even if your team is distributed. Just install the tax practice workflow software anywhere you want to create an authorized workstation. Managers can remotely assign binders, monitor progress, and grant or revoke access as needed.

INTEGRATION: When the tax return is complete, use SPbinder’s easy Print to PDF feature. Print one copy with annotations for internal storage and one clean copy for client delivery in TaxCaddy.

Tax practice workflow software has strict security protocols

As a tax professional, you handle sensitive data. Your clients trust you to keep their personal information secure. Generic solutions can’t accommodate this industry-specific need. Your remote tax workflow needs to run on specialized software that enforces your security standards and safeguards your reputation.

SurePrep’s data centers and cloud services are SOC 2 Type 2 and SSAE 18 certified. We mask all data transmissions with industry-standard 4096-bit Secure Socket Layer encryption—the same encryption used for banking transactions. Three of the Big 4 have independently audited SurePrep’s security protocols and are now SurePrep clients. Our servers and firewalls are monitored 24/7.

If security concerns were holding back your plans for a hybrid office, you can revisit the conversation. SurePrep has you covered from end to end.

The future of remote work in tax preparation

The American Institute of CPAs (AICPA) 2021 Trends report confirms the industry’s ongoing staffing crisis. The total hiring of new accounting graduates by U.S. CPA firms for accounting and finance functions decreased by 36% between 2014 and 2020. The number of CPA exam candidates is also trending down, dropping by 15,818 (33%) in just five years. In fact, 2021 had the lowest number of candidates who passed the fourth section of the CPA exam since 2007.

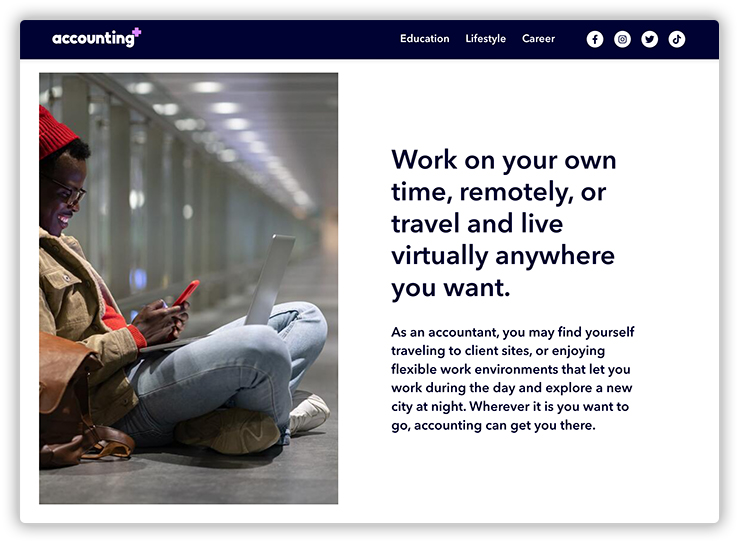

In January 2022, The Center for Audit Quality (affiliated with the AICPA) announced a strategic initiative to increase the diversity of talent coming into the field. As part of their effort to attract a new generation of accountants, they created Accounting+.

The Accounting+ website is designed to sell the merits of an accounting career to Gen Z. It breaks the argument into three axes: Education, Lifestyle, and Career.

First item in Lifestyle? The promise of a hybrid career.

While Gen Z is less likely to prefer 100% remote work, they expect hybrid flexibility. Ginsey Stephenson, a 23-year-old professional, captured this attitude in her interview with The Washington Post. Stephenson currently works three days per week on-site.

I actually love going into the office—it feels more organic. But I don’t know how anyone went into the office every day. I don’t know if we were cut out to work in a pre-covid world.

Ginsey Stephenson, 23-year-old professional

The first wave of Gen Z has already graduated college. What does this mean for your firm’s 5-year, even 10-year plan?

Competition for the narrow pool of next-generation accountants is already fierce. Today’s recent graduates are tomorrow’s experienced professionals. Firms that have the infrastructure to offer remote flexibility will not only attract candidates today, but also meet the expectations of tomorrow. The time to build your remote 1040 workflow is now—not when it’s too late.

Is SurePrep’s tax practice workflow software the right solution for your firm?

Request a one-on-one demonstration with a product expert for a full software walkthrough, pricing information, and implementation timeline.

Schedule a Demo