Interactive Demonstration

Experience the entire SurePrep tax process from start to finish.

Introduction

Remote 1040 workflows continue to be successful in the tax and accounting industry.

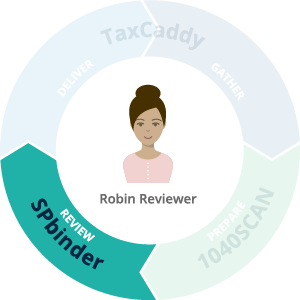

TaxCaddy

Collaborate remotely with your 1040 clients on our mobile platform.

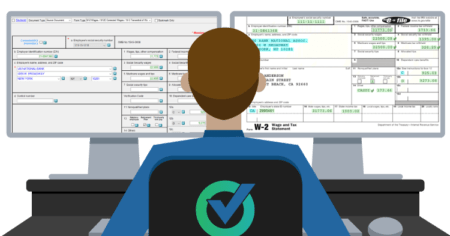

1040SCAN

Eliminate data entry with our next-generation scan and populate solution

SPbinder

Review and collaborate remotely with our cloud-based tax workpaper system.

Security

Protect your reputation with ironclad security protocols.

Remote collaboration: The future of tax work

Firms are recognizing the recruitment and retention benefits of hybrid and remote work options.

Not long ago, establishing a remote 1040 workflow was an afterthought in the tax space. Even as more and more firms embraced digital solutions, few considered leveraging them in a work-from-home(WFH) environment. Then, unprecedented circumstances forced the industry to hastily adapt at the peak of busy season. With minimal preparation and pressing deadlines, firms across the nation had to rely on remote 1040 collaboration for the first time ever. Here’s how the experiment fared:

PricewaterhouseCoopers (PwC) surveyed employers in 2021 and found that 83% considered their remote work experience successful. A Q4 2022 survey by RSM revealed that 74% of middle market businesses allowed some degree of hybrid flexibility.

The 2022 ConvergenceCoaching, LLC® Anytime, Anywhere Work™ (ATAWW) Survey even highlighted a staggering 97% of 216 accounting firms allowing their staff to choose where they work.

Remote work looks like it’s here to stay. Firms can either spend energy resisting the reality of the new landscape or focus on adapting to it.

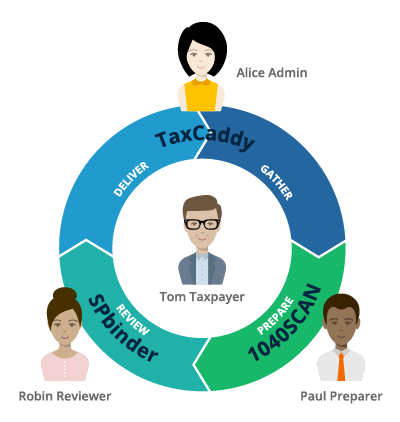

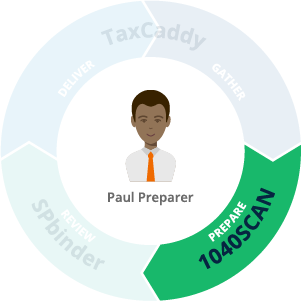

SurePrep is the industry leader in 1040 tax automation technology, which is the foundation for a remote tax preparation infrastructure. Our solutions integrate with your existing tax software to create a 100% digital workflow that enables processing a tax return from beginning to end without ever stepping foot in the office. This extends to everyone who touches the return, including clients and administrative staff, who are often left out of the equation. Through a combination of client- and staff-facing tools, we provide the infrastructure for a secure, streamlined, fully remote 1040 workflow that keeps everyone connected while apart.

SurePrep is the industry leader in 1040 tax automation technology, which is the foundation for a remote-enabled tax preparation process. Our solutions integrate with your existing tax software to create a 100% digital workflow that enables processing a tax return from beginning to end without ever stepping foot in the office. This extends to everyone who touches the return, including clients and administrative staff. Through a combination of client- and staff-facing tools, we provide the infrastructure for a secure, streamlined, fully remote 1040 tax automation workflow that keeps everyone connected while physically apart.

In this whitepaper, we’ll provide detailed information on our products TaxCaddy, 1040SCAN, and SPbinder. We’ll show you how these industry-leading 1040 tax automation solutions enable your entire team—including administrative staff—to work from anywhere without sacrificing efficiency, security, or the client experience.

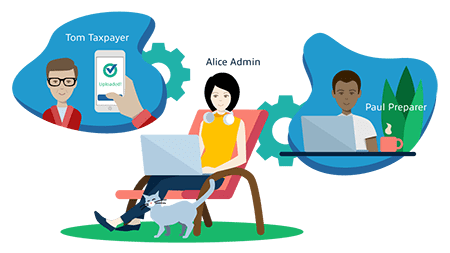

The role of an administrator has always been intrinsically linked to the office. After all, they’re the first face you see when you walk in the door. They also manage the mailroom to receive incoming tax documents from clients, scan documents into the system, and mail out completed returns. In a traditional tax return preparation cycle, their presence in the office is essential for the process to function. Remote collaboration for admins and 1040 clients is a challenge that can easily be solved with SurePrep’s award-winning solution: TaxCaddy.

TaxCaddy is a digital taxpayer collaboration platform that converts the gathering and delivery of tax information into a fully electronic, cloud-based system, which eliminates the need to handle mail or scan paper documents. This empowers both admins and clients to complete their tasks from anywhere, including the comfort of their homes, without the need to print, scan, copy, or make trips to the post office. TaxCaddy digitizes every client-facing step in the process: gathering tax documents, receiving e-signatures, collecting questionnaires, answering queries, delivering the completed returns, invoicing, and receiving payment.

TaxCaddy is the missing link. It’s allowed our entire team to adjust to this new world without any hiccups.

— Tom W., Partner

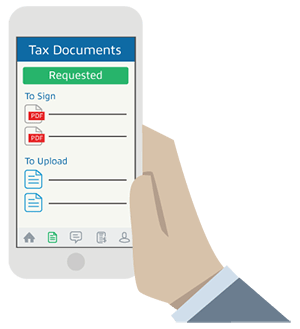

TaxCaddy uses proforma data in your current tax software to create a custom, automated Document Request List for each client. You can also supply the proforma data with a simple PDF import of last year’s tax return. The DRL makes it easy for clients to see exactly what they need to provide. Clients can submit their documents from any device, using several convenient options:

It’s worth looking at two of these options in closer detail.

TaxCaddy’s mobile photo-scan feature helps clients take clear, legible photo-scans that are Optical Character Recognition (OCR)-ready. The TaxCaddy app utilizes the same technology that allows smartphone users to deposit checks by scanning them with their bank’s mobile app. The ability to submit documents using a smartphone increases the likelihood that clients will submit documents incrementally, rather than hoarding them for one mass submission closer to the filing deadline.

It also increases client satisfaction: modern taxpayers expect the ability to submit documents using their phones. According to the Pew Research Center, 85% of Americans currently own smartphones. Analyzing the market saturation by age range indicates this trend will only continue to grow:

Ages 18–29: 96%

Ages 30–49: 95%

Ages 50–64: 83%

Ages 65+: 61%

Your clients can authorize leading financial institutions—such as banks, brokerages, and payroll servicers—to send tax documents directly to TaxCaddy as soon as they become available. By ensuring fast access to client documents, your firm can get a timely start on preparation and minimize peak season compression. Additionally, your clients will appreciate having fewer documents to track down and send.

It’s about the benefit and value to [our clients]. And it’s that much less effort that they have to put in. It enhances their experience in working with us.

— Michael Weinberg, President and Founder, WISE Financial Advisors

TaxCaddy integrates with SurePrep’s scan-and-populate solution, 1040SCAN. Taxpayer documents transfer securely from TaxCaddy to 1040SCAN with just a few clicks. No need for complicated middle steps like downloading and re-uploading or printing and scanning.

When 1040SCAN extracts OCR data from a native PDF, it can automatically verify the information with text-layer matching. This technology is patented by SurePrep and not offered by any of our competitors. In the 2019, 2020, and 2021 tax seasons, 62% of the documents submitted through TaxCaddy were in native PDF format. Our latest user data shows that SurePrep customers who collected tax documents through TaxCaddy saw a 22% decrease in verification costs. If your scan-and-populate solution doesn’t auto-verify native PDF OCR data, it’s costing you time and money, which negatively affects your bottom line.

Did you know? SurePrep doesn’t only auto-verify native PDFs. Our patented Artificial Intelligence can auto-verify a portion of your scanned documents. Combined, these SurePrep technologies auto-verify 65% of standard documents.

1040SCAN extracts information from tax documents using OCR technology. Information extracted with OCR requires verification. However, firms that collect documents using TaxCaddy’s Smart Links feature enjoy a major cost-saving advantage during the verification stage. Why? Documents that arrive through Smart Links are always in native PDF format.

TaxCaddy features a built-in messaging center that facilitates direct, secured communications between taxpayers and tax professionals. This keeps communication flowing without the need for in-person meetings. The messaging center uses the same end-to-end encryption that keeps taxpayers’ documents safe, which makes it a more appropriate place for sensitive tax information than email. It also eliminates the problem of email messages becoming lost in a crowded inbox. Both sides can initiate a chat, and messages can be attached to specific documents so that the referenced item is always clear. Taxpayers and tax professionals can access the messaging center from any device through the TaxCaddy mobile app or browser. The mobile app also offers optional push notifications for incoming messages, which will allow you to elevate your client service with quick response times.

TaxCaddy also makes it easy to personalize outbound letters and communiqués at scale. The built-in mail merge feature can be used to mass-generate engagement letters, statements of work, 7216 consent forms, privacy policy statements, and service and preparation fee notices. These documents are pushed directly to the taxpayers’ TaxCaddy accounts; no paper mail required.

Clients may be feeling anxious during office closures. The assurance that their tax professional is just a tap away is critical to satisfaction and retention.

Questionnaires are filed alongside all other documents and tax information in TaxCaddy, which serves as your client’s electronic tax organizer.

The intuitive interface displays one question at a time to prevent taxpayers from feeling overwhelmed and to encourage completion. TaxCaddy automatically saves questionnaire progress, which means clients can pick up where they left off on any device, any time.

Once a tax return is finished, it can be electronically delivered through TaxCaddy. Your administrative staff doesn’t need to print, fold, stamp, or mail a thing. A digital tax return delivery is a one-step task: upload the completed return to TaxCaddy, along with the Form 8879 and invoice. Clients can then log into their TaxCaddy accounts, instantly view and download their returns, provide their e-signatures, and pay their invoices—from any device. Taxpayers can pay their invoice from within TaxCaddy using credit card, ACH, Apple Pay, or Google Pay.

It’s important to note that not all e-signatures are created equal. The IRS requires Knowledge-Based Authentication when e-signing Form 8879. TaxCaddy’s e-signatures are 100% IRS compliant.

TaxCaddy also integrates fully with SafeSend Returns, supporting firms already using this service.

Taxpayers can also make their state and federal tax payments using TaxCaddy’s Pay by Check feature. A digital check display makes it easy for taxpayers to confirm payment information before TaxCaddy mails the physical check on their behalf. Keep an eye on the SurePrep blog for new feature announcements as we continue to evolve the frictionless tax experience that clients love and use.

The taxpayer experience drives our development process. It’s our goal to make products with high adoption rates that your clients love and use. To that end, we use an independent 3rd party service called TechValidate to impartially survey TaxCaddy users.

Adopt 1040 client-centric habits and workflows

View WebinarTaxCaddy is a two-time finalist for the CPA Practice Advisor Technology Innovation Award with great ratings in the Apple App Store and Google Play Store. It gives your administrative staff the flexibility to work remotely without any interruption in service. It provides your clients a way to do their part from anywhere, on any device, and sends the message that their wellbeing and convenience is also top-of-mind.

Next, we’ll examine how TaxCaddy integrates with 1040SCAN and SPbinder to enable remote options during the preparation and review phases of a return.

The paperless tax information gathered through TaxCaddy flows into the most powerful scan and populate software in the industry: 1040SCAN. This integration eliminates the printing and scanning normally associated with OCR. That said, if there are any paper documents collected outside of TaxCaddy, running them through 1040SCAN is as simple as uploading a PDF of the scan.

Tax document automation occurs in three steps:

Step 1) Extraction: 1040SCAN extracts information from tax documents using OCR.

Step 2) Verification: 1040SCAN can automatically verifies the extracted OCR data on 65% of standard documents. Information retrieved from other sources can either be verified by your staff with our user-friendly Review Wizard or outsourced to trained SurePrep verifiers.

Step 3) Export: 1040SCAN exports the verified information directly into your tax software. The documents are automatically bookmarked and organized in SPbinder to follow the flow of the tax return.

The entire 1040SCAN process is cloud-based. Workpapers are stored in our highly secure, encrypted servers, which means your team can access them from any authorized device. Keeping documents centralized in this way is essential for remote collaboration and eliminates the painstaking logistics of sending documents back and forth.

1040SCAN also distinguishes itself from other scan and populate solutions in three important ways:

1. 1040SCAN automates 4–7x as many documents as the alternatives [see how 1040SCAN stacks up]. It also extracts more granular data by recognizing fields that other scan and populate software ignore, such as margin interest, investment fees, and foreign income on brokerage statements.

2. Before exporting OCR-extracted data to tax software, it’s a strongly encouraged best practice to have extracted data verified by a secondary source. 1040SCAN uses patented, AI-powered technology to auto-verify data on nearly two-thirds of scanned documents.

For the remaining data, SurePrep is the only company that offers an optional verification outsource service. 1040SCANverify is a hybrid of software and service where our professional staff verify OCR data on your behalf. This is our most popular option, as firms of all sizes have found it to be a cost-effective alternative to hiring seasonal staff or outsourcing the entire preparation phase of the tax return.

3.Some scan-and-populate solutions require users to insert cover pages between document types. 1040SCAN needs no such assistance; it automatically recognizes, bookmarks, and sorts documents, even when you scan in bulk.

Once 1040SCAN reads and organizes your digital tax workpapers, your team is ready to begin preparation and review in SPbinder.

Now that all your workpapers are digital, you can prepare and review remotely more efficiently than ever before with SPbinder’s cloud-based binders.

SPbinder, our award-winning tax workpaper system, is included with all 1040SCAN purchases to cost-effectively bring your digital workflow full circle.

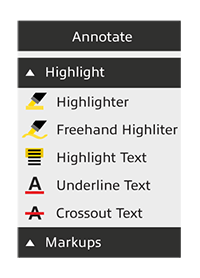

Just as they would on paper, your preparers can place tick marks, notes, and calculator tape directly on any document, regardless of file type. Other programs restrict these functions by file type, which is odd; there’s no wrong type of paper for your pencil, so why should there be a wrong file type for your keyboard?

Each of these familiar paper-emulating tools come with technological boosts. Digital tick marks are standardized, which increases legibility. Notes can be linked to specific documents, and other users can add threaded responses. A dedicated Notes tab means you never lose track. SPbinder’s calculator tape even has built-in OCR functionality; simply click and drag across the amounts you wish to capture, and they’ll appear in the calculator tool.

One of SPbinder’s most powerful functionalities is hyperlinked cross-references. Users can create clickable links between any two points on any two documents—again, regardless of file type. If you opt to use SPbinder’s Leadsheets, hyperlinks are automatically generated between the final amounts listed on the leadsheets and the underlying source documents. When reviewers want to know where an amount came from, a single click will open the source document in a split-screen view. This creates a lightning-fast review process compared to the hours reviewers once spent digging through piles of paper to verify information.

There are three key aspects that make SPbinder the perfect remote collaboration tool: cloud-based binders, change tracking, and multi-level sign-offs.

All binders live in one centralized location in the cloud. This means team members are always working on the same version. If you’ve ever tried to pass a digital file around the office and ended up with file names like, “John_Doe_1040_FinalVersion2_ActualFinal.pdf,” you know how essential centralized files are to collaboration.

When multiple team members are touching the same document, it’s essential to know who did what. SPbinder tracks what changes were made by whom, and when. This information is readily available in an easy-to-read change log, so your team can avoid a game of phone tag to find out who made a change. Reviewers who use leadsheets will see change alert icons whenever SPbinder logs a change that could affect a final amount. Reviewing the change is as simple as hovering your mouse over the icon. If the change is immaterial, double click to accept it.

Your firm can enable up to four sign-off levels. This means that someone from each level in the preparation and/or review workflow must sign off on every workpaper. For example, you may mandate that one preparer, one mid-level reviewer, and one partner must sign off on every item before the binder is considered complete. If anyone makes a change to a workpaper, the sign-off levels reset for that individual item. This feature creates a structure for accountability that is extra necessary in a remote work environment, and clearly defines which areas of the tax workpapers still need to be reviewed.

SPbinder will keep your team on the same page, eliminate labor redundancy, and allow you to maintain a standardized digital 1040 workflow. Once a binder is fully reviewed, the information exports to your existing tax software with a single click.

Your first consideration when evaluating web-based applications should always be security. If you’re going to transmit sensitive client data to a cloud-based service, you need to know the security protocols that protect those servers are ironclad. Your reputation depends on it.

SurePrep adheres to strict security standards that are well-documented, transparent, and recognized by independent third parties. Consider the following:

With over 250,000 taxpayer accounts, TaxCaddy is the most trusted, most recognized name in digital tax client collaboration. For the 2021 tax year, clients submitted approximately 1.9 million documents using our secure system. That’s 1.9 million votes of confidence, and for good reason.

As part of your custom onboarding plan, SurePrep will provide taxpayer communication templates that outline our extensive security measures. Proactive communication about privacy and security will bolster trust and adoption rates.

Bottom line: Transitioning to a remote-capable workflow does not mean sacrificing security.

Remote work isn’t just another passing fad. In an industry where talent is increasingly difficult to come by, qualified tax professionals are using their leverage to demand hybrid and remote accommodations. Of the 8,090 remote-capable U.S. employees surveyed by Gallup in June 2022, 94% preferred hybrid or remote work. 60% of remote workers even indicated they were “extremely likely” to seek employment elsewhere if asked to return to the office.

Observant leaders have seemingly acknowledged this reality. In Deloitte’s CFO Signals™ 3Q 2022 study, 71% of CFOs said providing flexibility for work location was the most effective action for retaining talent.

Your firm doesn’t have to sacrifice productivity to adjust to the new normal of tax preparation. A streamlined, end-to-end digital 1040 workflow is possible. SurePrep’s automated tax technology is trusted by three of the Big 4, seven of the Top 10, and more than 23,000 tax professionals. Is a remote 1040 workflow in your firm’s future? Learn more about SurePrep solutions by filling out our Contact Sales form. A product expert will get in touch within one business day to schedule a consultation.

Contact SalesContact one of our product experts to ask questions or schedule a one-on-one demonstration.

CONTACT SALES