Interactive Demonstration

Experience the entire SurePrep tax process from start to finish.

APIs make software integration easier, more efficient, and customizable. Developers use APIs to minimize or remove manual actions by creating interactions between programs.

For example: Have you ever wished you could pull all your notifications into one place? Auto-download that report at the end of the week? Copy-and-paste information from one platform to another without the back-and-forth? These are just a few examples of the types of actions that can be automated with an API.

SurePrep’s API functionality is rapidly expanding. This page highlights key features, but is not comprehensive. For a complete list of all API products, please visit our Developer Portal and browse API Products.

SurePrep’s API offers a wide array of functions to manage your digital binders from your preferred interface. Via API, you can initiate binder creation, upload documents, and submit binders for OCR with 1040SCAN. Once the binder is ready for preparation, you can track or edit its status, view binder details, download documents, and much more.

In the review phase, you can pull in tasks that would normally populate the Review Tree, like uncleared notes or unreviewed stamps. You can download unreviewed workpapers by sign-off level. You can even pull a full audit report of binder events.

When a binder is ready for storage, you can use API integration to print the final returns to PDF (or DreamWorkpapers).

Client management can be streamlined with API actions like downloading taxpayer DRLs, generating missing document reports, pulling lists of documents awaiting signatures, updating account owners, fetching billing history, and more.

Monitor your workflow by using API to pull notifications when the status of a binder or a DRL changes, when new files are available, or when your taxpayers have uploaded new documents.

SurePrep supports your developers with a dedicated Developer Portal.

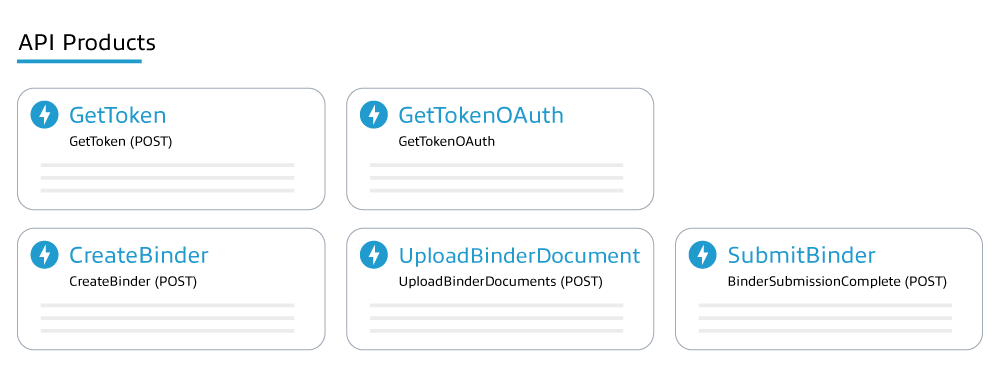

In the Portal, you’ll find all the API Products discussed above (and many more), neatly organized by category.

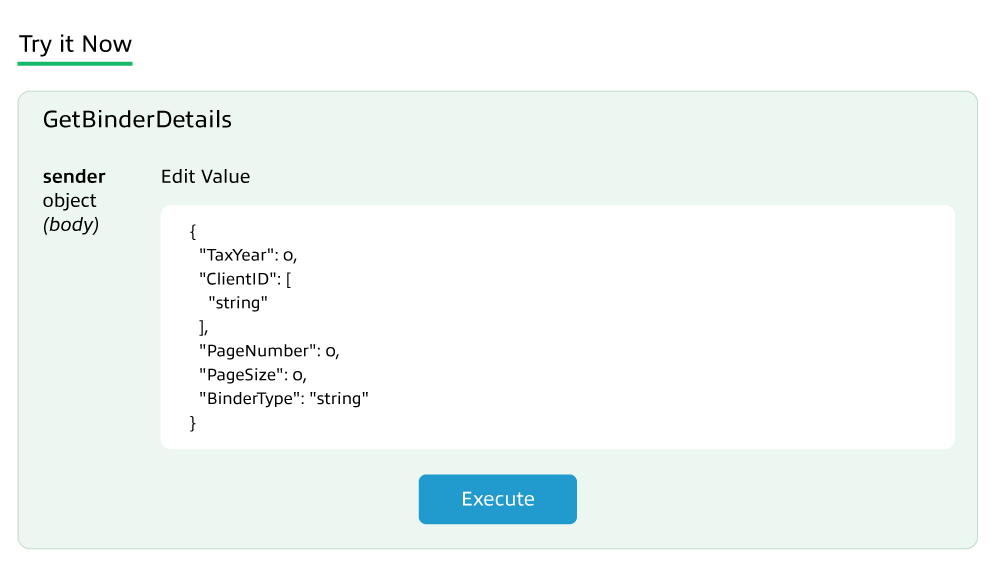

Each product module links to thorough documentation and to a sandbox environment that your developers can use to test the API scripts right in their browsers.

Complete documentation for all API calls is also available in the Docs tab.

In addition to the API Products themselves, the Developer Portal contains useful resources like a Getting Started guide, Downloads, and developer Support.

The Getting Started guide walks your developers through enabling SurePrep API for your domain, adjusting domain settings, account admin set-up, and API set-up for TaxCaddy users. The Downloads section contains downloadable scripts, documents, and—soon—SDK’s. The Support section contains FAQs on the API, as well as a contact form that will connect developers with the specialized support they need.

Visit our Developer Portal to get a first-hand glimpse of how the SurePrep API works.

For larger firms with more complex technology stacks, API integration can make all the difference to workflow efficiency. Consult with your developers and consider what flexibility you might need when evaluating a tax automation solution. Robust API support is a positive sign of a well-maintained technology product capable of scale. If a technology vendor does not offer API, we recommend extra due diligence to determine if the product can support your firm’s unique needs.