Interactive Demonstration

Experience the entire SurePrep tax process from start to finish.

Our whitepaper answers your most pressing questions. What are cryptocurrencies and how do your clients trade them? What blockchain activity does the IRS consider taxable events? How do you navigate confusing cryptocurrency wallet and exchange reports? We outline the easiest way to ensure accurate Form 8949 reporting, even if you’re not a crypto expert.

View Whitepaper

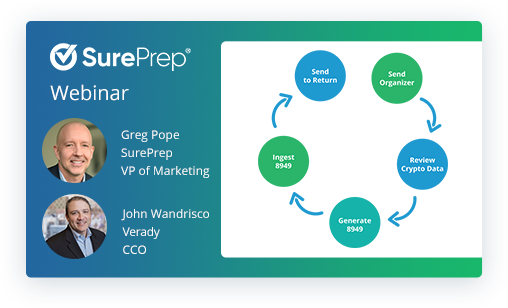

Ledgible Tax Pro by Verady is the first cryptocurrency solution designed for tax professionals. SurePrep partnered with Verady to bring you this comprehensive webinar on cryptocurrency and 1040 preparation. See a full software walkthrough of how Verady integrates with SurePrep solutions to resolve the most common cryptocurrency challenges in tax preparation.

View Webinar

SurePrep partnered with CoinTracker to bring you this educational webinar. You’ll learn how to identify cryptocurrencies, how they’re taxed, and what information you need from taxpayers. The Head of Tax Strategy at CoinTracker will run through some critical considerations to look out for when determining taxability and calculating obligations on crypto gains.

View Webinar

SurePrep technology makes it easy to gather cryptocurrency documentation from clients. Our automation pulls data from Form 8949 and exports directly to your tax software. We integrate with leading cryptocurrency solutions. For a personalized consultation, fill out the form below. We’ll reach out within 1 business day (usually 1 business hour) to connect you with a product expert.