Interactive Demonstration

Experience the entire SurePrep tax process from start to finish.

TaxCaddy makes it easy to deliver tax payment vouchers to your clients, track when payments are due, and update payment status. Your clients can pay their state and federal taxes directly from TaxCaddy if your firm chooses to enable the Pay by Check feature. This feature lets your clients submit their payments online, while TaxCaddy mails a paper check to the proper taxing authority on their behalf.

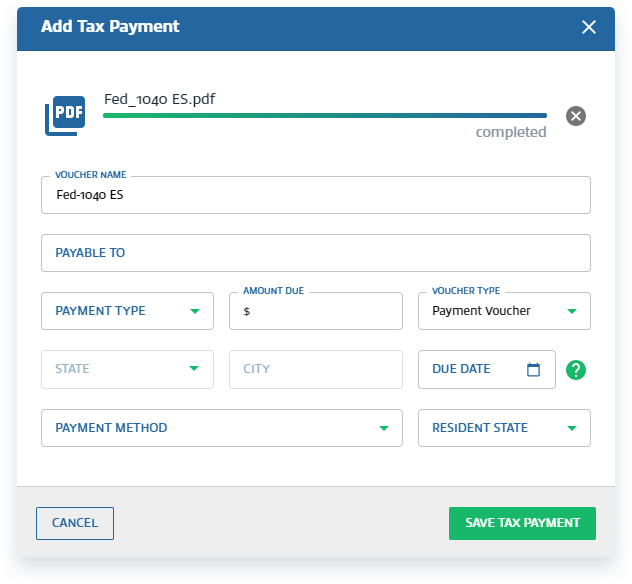

You can deliver payment vouchers to your clients under the Tax Payments tab on your client’s TaxCaddy profile. Simply drag and drop a PDF of the voucher into the Upload area. You’ll be prompted to enter the following fields before saving. TaxCaddy will auto-sort the voucher into the respective Tax Year based on Voucher Type and Due Date.

There are 3 types of Payment Methods to select from:

Standard Payment: Indicates that the taxpayer can use their preferred method of payment, including Pay by Check (if enabled).

Online Payment: Indicates that the taxpayer should pay online, not mail a check.

Scheduled Automatic Withdrawal: Indicates to the taxpayer that the payment is scheduled to be automatically processed.

If the payment is processed outside of TaxCaddy, you and your client both have the ability to mark the voucher as paid and specify the date and amount. You can also edit and delete existing payment vouchers.

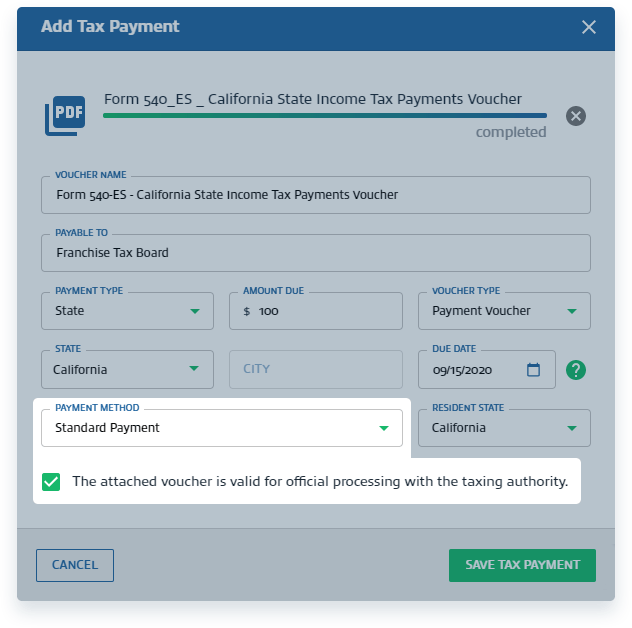

Taxpayers can make State or Federal tax payments from their TaxCaddy accounts if your firm has the Pay by Check feature enabled. You must select Standard Payment as the Payment Method to make a voucher eligible for Pay by Check. The voucher must also be valid for official processing with the taxing authority.

Here is an example of a payment voucher that is eligible for tax payment processing by check:

Taxpayers can access the Pay by Check feature via desktop browser or the TaxCaddy app on iOS and Android. When they open an eligible voucher, they will see a Pay by Check option.

When your client selects this option, TaxCaddy will prompt them to add a bank account or select one that was previously added. Adding a bank account can be done through Instant Verification or Manual Verification.

Instant verification: The taxpayer signs in with the login credentials for their bank account.

Manual verification: The taxpayer inputs their account number and routing number. Manual Verification can take up to two business days to confirm.

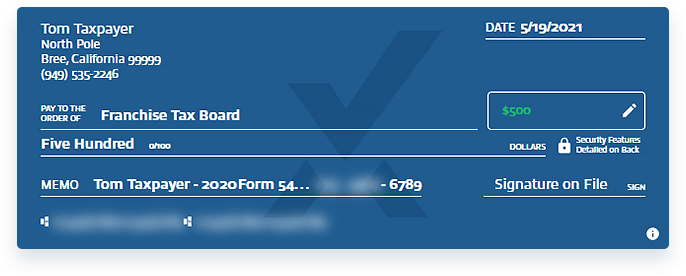

Once a bank account is connected, your client will be asked to provide a return address and verify that their amount due is correct. TaxCaddy then generates a digital check proof for your client to review before they submit their payment. If your client needs to modify the check amount, they can simply click in the amount field and type a new number.

Next to the digital proof, your client will see two mailing options: USPS First Class Mail and USPS Certified Mail. Your firm can choose whether to cover mailing costs for your clients or to pass along the cost. If you choose to pass the cost to your clients, they will see pricing information next to each mailing method.

Once your client submits the payment, TaxCaddy sends a paper check to the proper taxing authority on their behalf. Your client receives a confirmation email and a link to track the payment delivery.