Interactive Demonstration

Experience the entire SurePrep tax process from start to finish.

TaxCaddy integrates directly with 1040SCAN and SPbinder.

1040SCAN is SurePrep’s scan-and-populate solution. 1040SCAN extracts data from tax documents and exports that data directly to your tax software. It also bookmarks and organizes your digital workpapers into an index that follows the flow of the tax return.

SPbinder is SurePrep’s workpaper management system. The indexes created by 1040SCAN appear here. Your tax professionals launch digital binders in the SPbinder software to prepare and review. All changes made in SPbinder sync to the cloud.

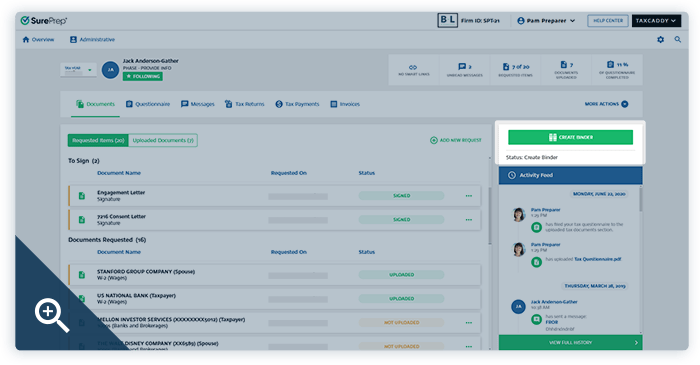

Step 1: Your tax professional initiates binder creation

When a client has delivered enough requested documents to begin the preparation process, your staff can create a digital binder through the TaxCaddy interface by clicking Create Binder. Doing so will immediately prompt them to select a 1040SCAN service level for the binder.

Clients sometimes submit unnecessary documents. Your staff can choose which documents to include in the binder from a simple checkbox list of the client’s submissions.

Once your staff clicks Submit, the tax documents are routed to SurePrep’s OCR servers and processed through 1040SCAN.

Step 2: 1040SCAN processes your client’s documents

Turnaround time depends on the 1040SCAN service level selected and the number of pages submitted. Each service level refers to units purchased in one of the four versions of 1040SCAN. Read more about the different versions/service levels→

Once the 1040SCAN process is complete, the tax professional assigned to the binder receives a notification.

Step 3: Your tax professional verifies data (optional)

To skip this step, process documents with the 1040SCANverify service level. With 1040SCANverify, professional SurePrep verifiers ensure the accuracy of your data.

For all other service levels, your staff can now launch the workpapers in our user-friendly Review Wizard software which walks them through the data verification process. Users are prompted to resolve any OCR errors and assign parent/child document relationships.

When verification is complete and your staff clicks Finish, the verified data exports directly to your tax software and the newly created binder saves to the cloud.

Back in the TaxCaddy interface, the Create Binder button has now been replaced by Add Documents and Open Binder.

The Add Documents option lets your staff submit additional tax documents to the client’s binder at any time. Open Binder launches the client’s binder in SPbinder, where your staff can begin the preparation process using SPbinder’s preparation and review features.